PEAK with the new function designed to enhance efficiency.

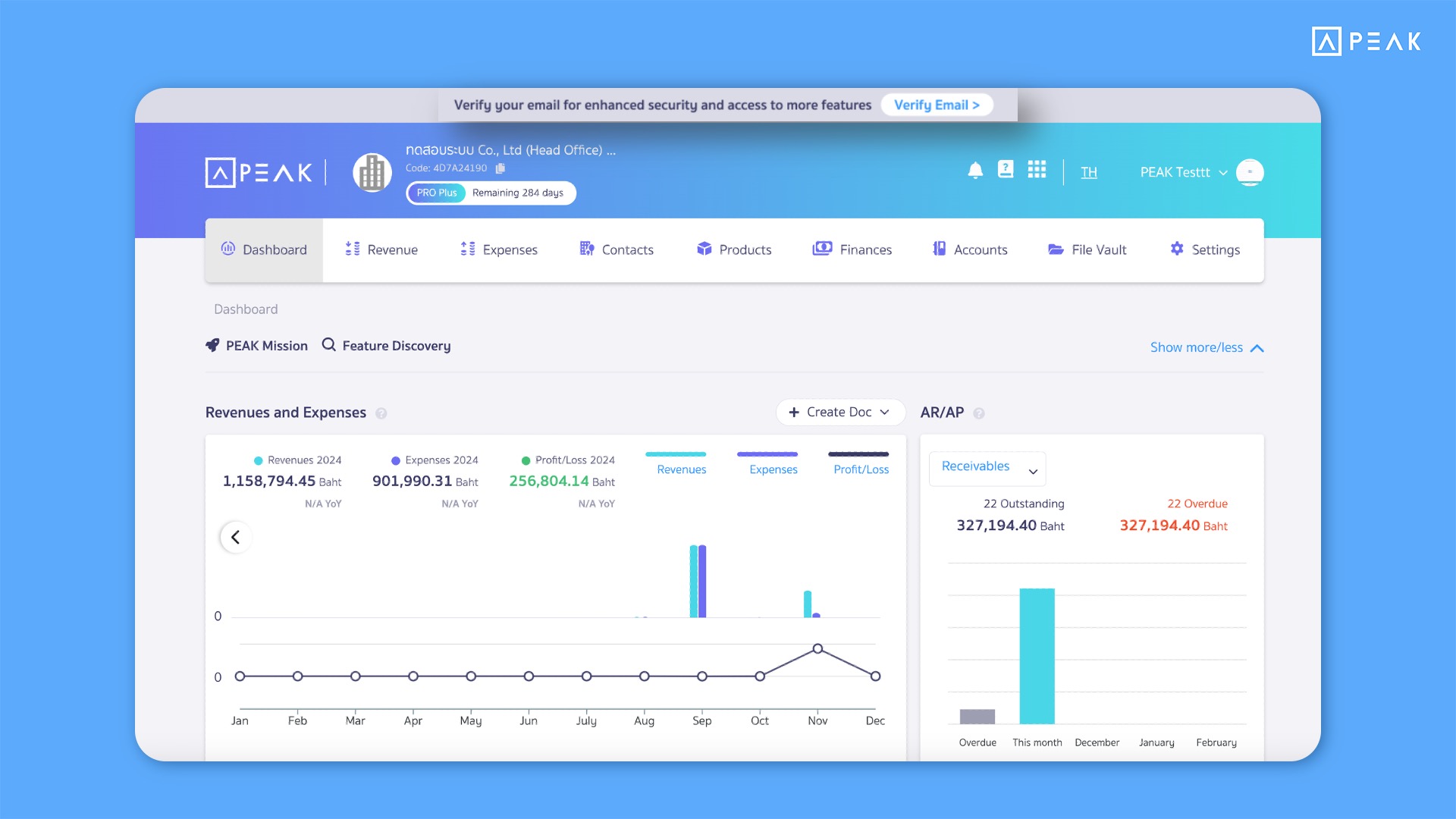

✨ 1. Restricted access to certain features for users who have not yet verified their email to enhance data security.

📢For users who have not yet verified their email, access to certain key features will be restricted, including:

- Connecting to e-Tax

- Sending documents via email

- Creating recurring documents automatically

- Transferring Super Admin rights

- Deleting business accounts

These restrictions help prevent the use of invalid email addresses, reduce the risk of sending data to unauthorized parties, and enhance data security.

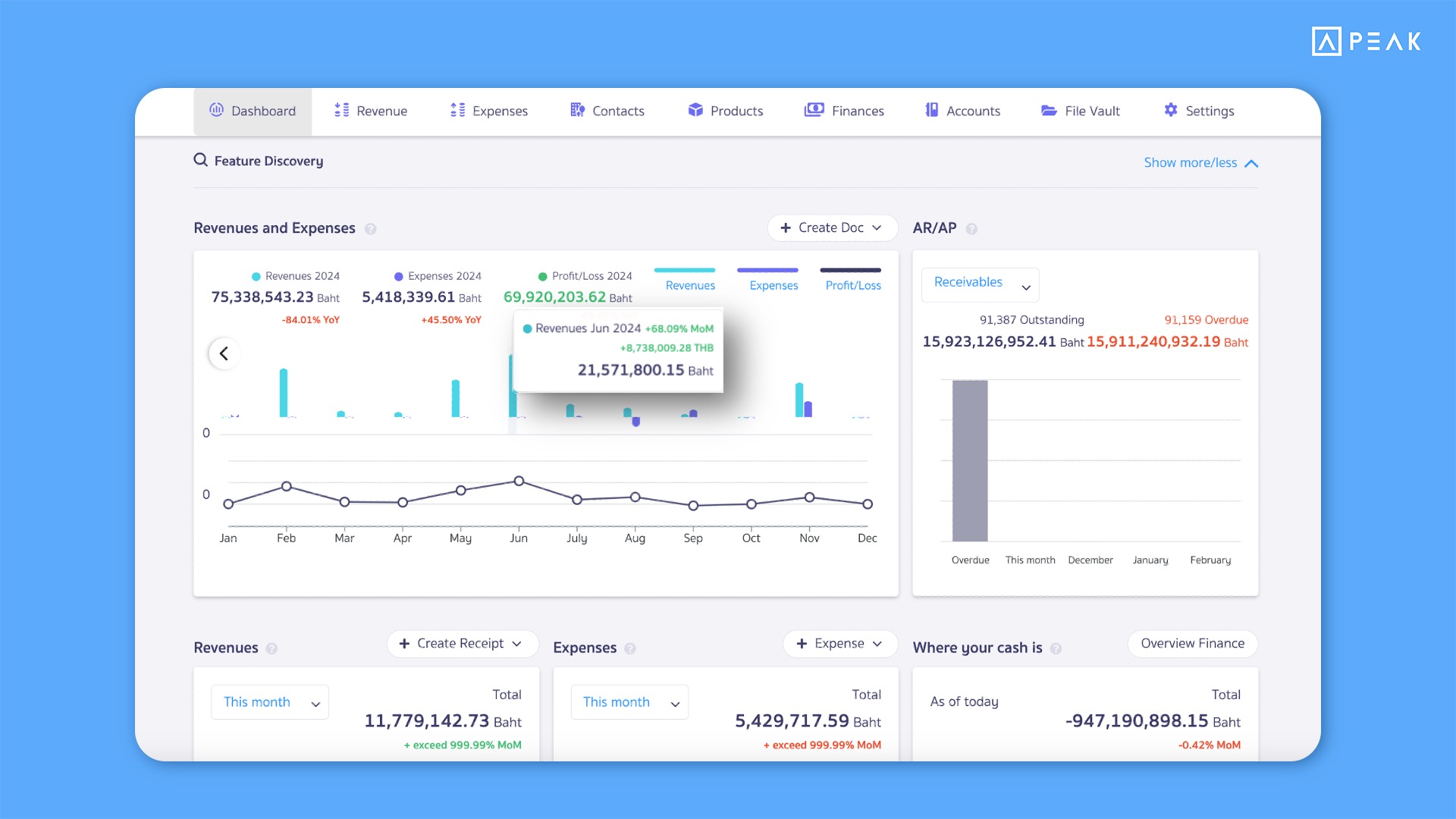

✨ 2. Added monthly comparison figures on the main Dashboard to make it easier to track performance.

📢For businesses that need an overview of income and expenses on the main menu dashboard, the system now includes monthly comparison figures. The display works as follows:

- If this month’s value is lower than last month’s, it will show a negative value in red text.

- If this month’s value is higher than last month’s, it will show a positive value in green text.

This feature allows users to clearly and quickly analyze differences in financial data.

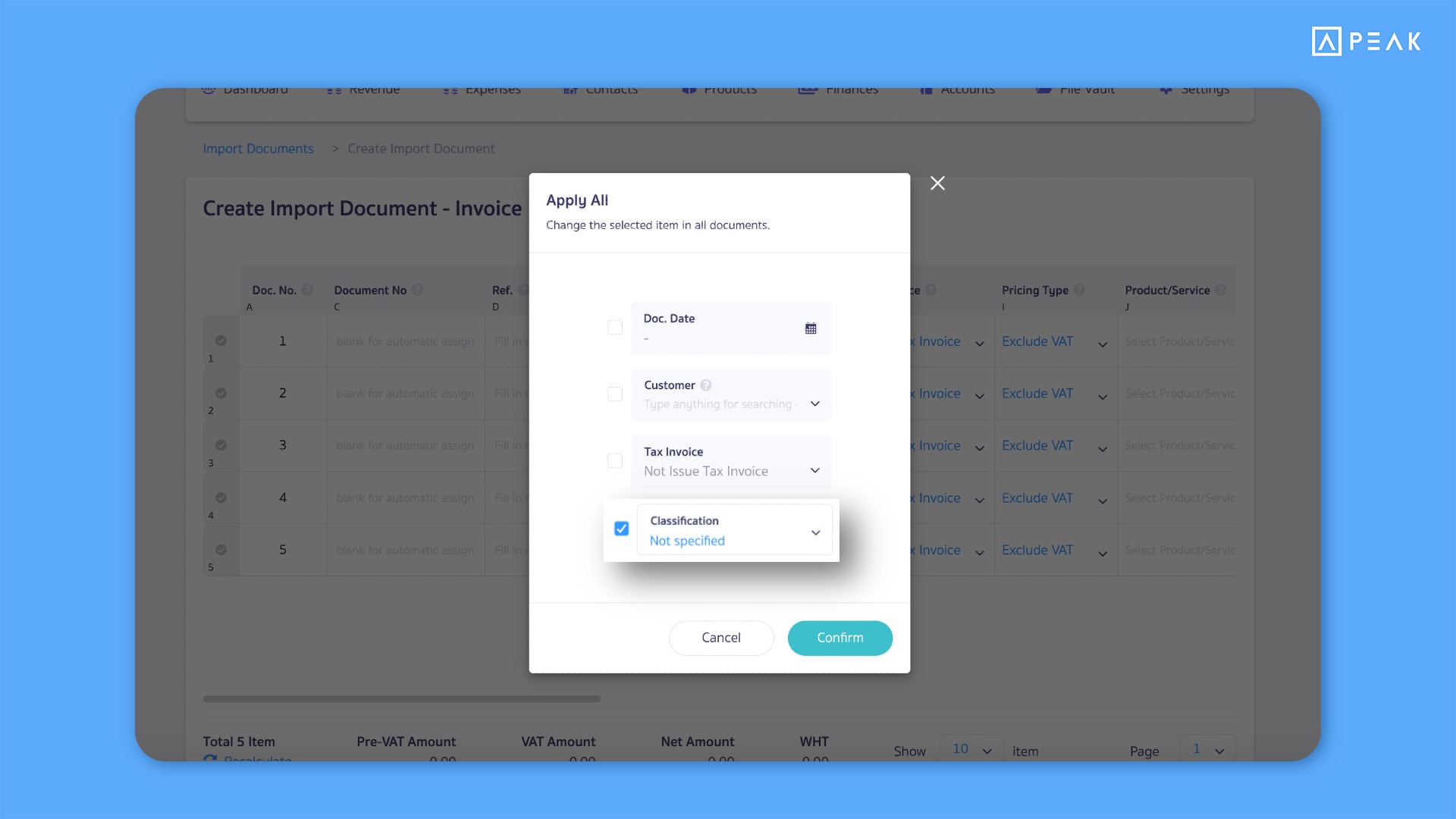

✨ 3. Included the “Classifications” section from the Apply All in the multi-document creation page to reduce workflow steps.

📢For businesses using the Pro Plus package or higher, you can now assign classification groups to multiple documents simultaneously. This can be done via the “Apply All” button on the multi-document creation page, helping reduce repetitive tasks and improve workflow efficiency.

Note: This function does not support assigning classification groups through importing documents via Excel files.

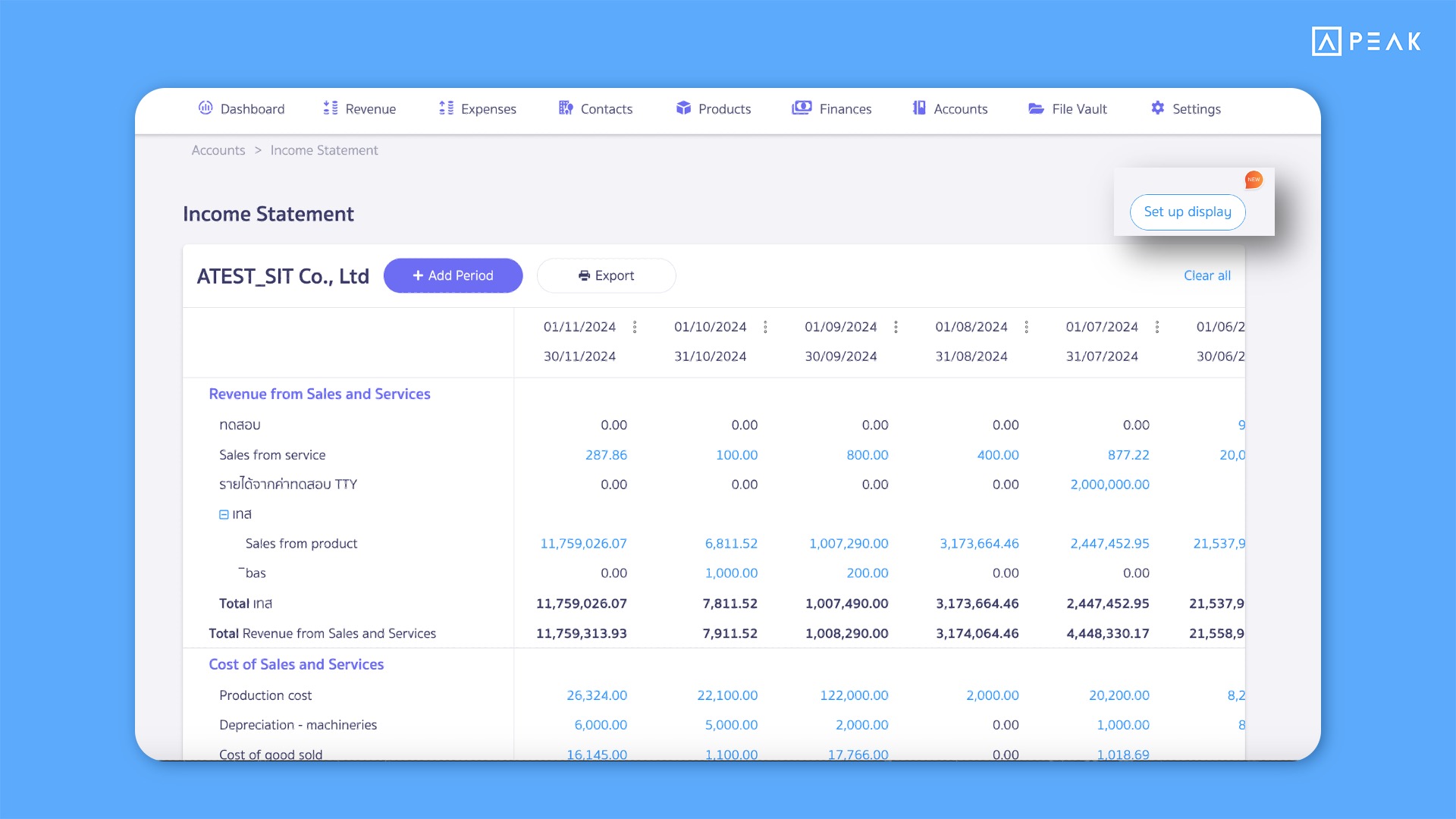

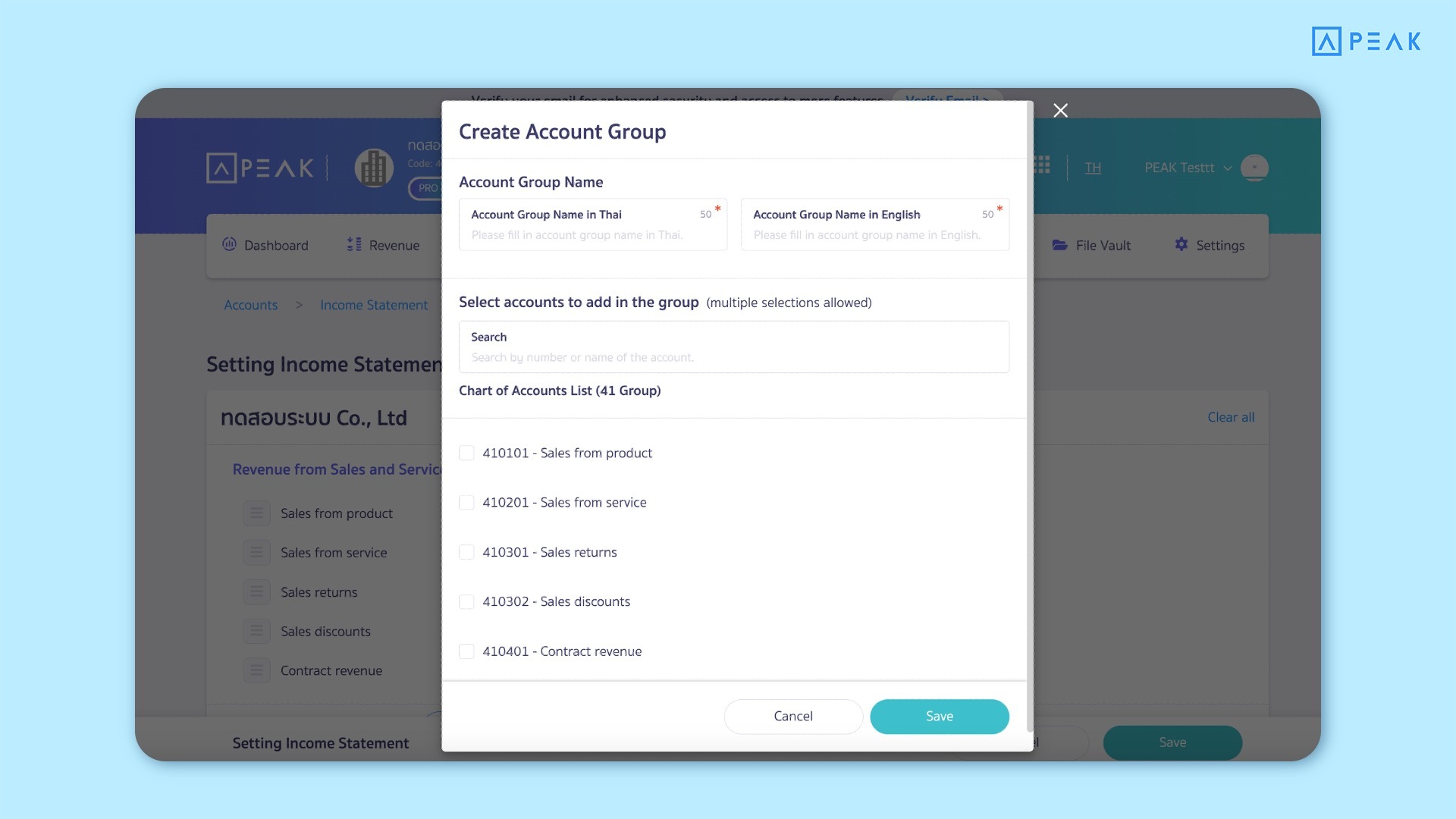

✨ 4. Added a “Set up display” button on the Income Statement page to customize data presentation as needed.

📢For businesses using the PRO Plus and Premium packages that need to customize data presentation in the Income Statement, the system now includes a “Set up display” button. Users can adjust the following:

- Rearrange the chart of accounts.

- Add account groups to specific sections.

This feature allows financial statements to be tailored to desired formats and ready for immediate presentation. Users can also reset the display to the system’s default settings, providing flexibility in Profit and Loss Statement customization.

Example of customized Profit and Loss Statement display adjustments.

✨ 5. Introduced new functions related to Deposit Document for greater convenience.

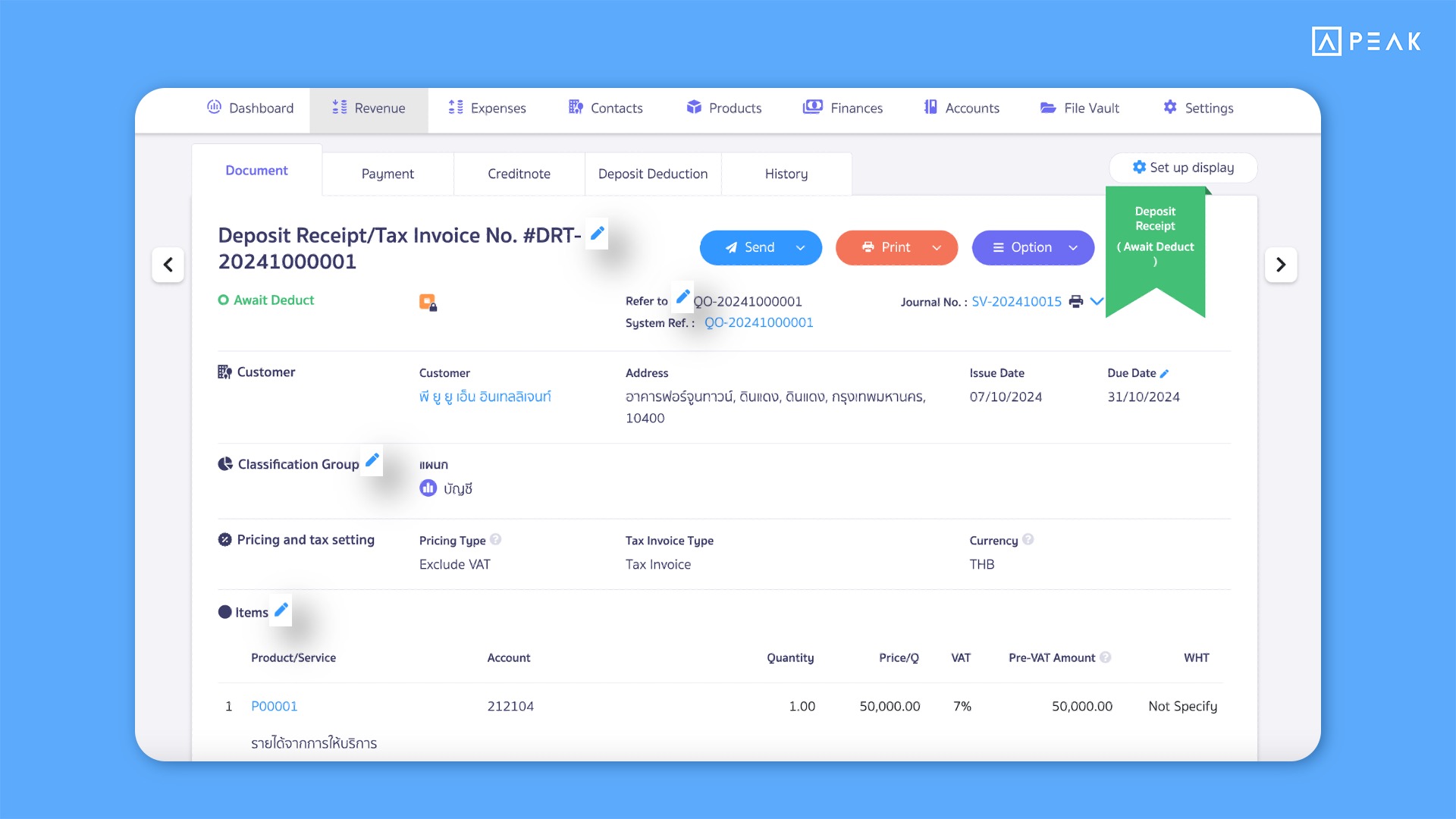

5.1 Enhanced the Easy Edit functionality on Document pages.

📢The system now includes an Easy Edit feature, allowing users to edit document details directly from the document page. This reduces workflow steps and makes document management more convenient and efficient.

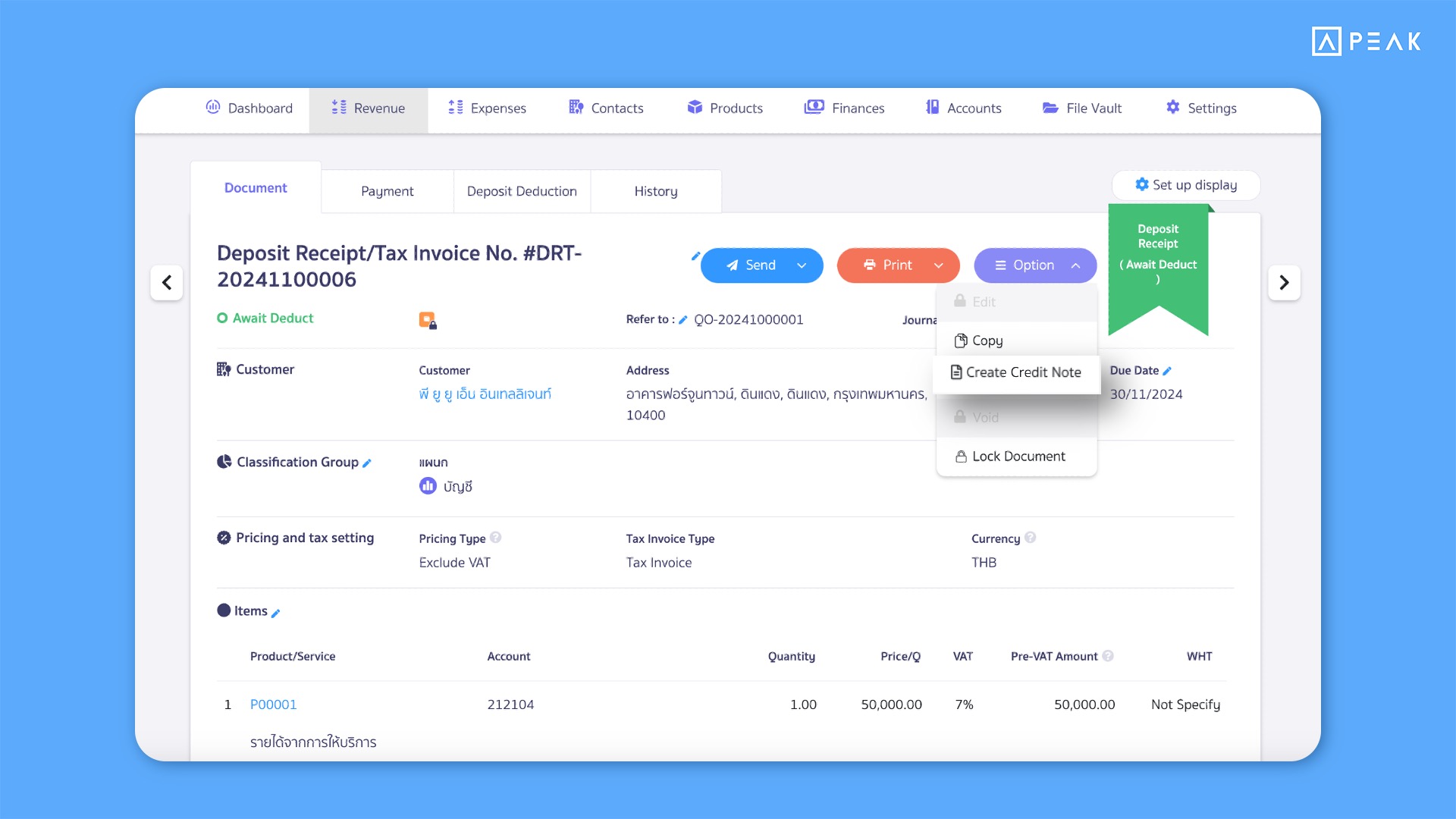

5.2 Enabled issuing Credit Notes directly from Deposit Documents.

📢Users can now issue Credit Notes based on Deposit Receipts or Deposit Payments, making it more convenient to process refunds or adjustments related to Deposits. However, Credit Notes issued with Deposit references cannot include returned goods. When issuing a Credit Note from the deposit page, the system will add an information tab and display the Credit Note in reports, ensuring users can access complete and clear data.

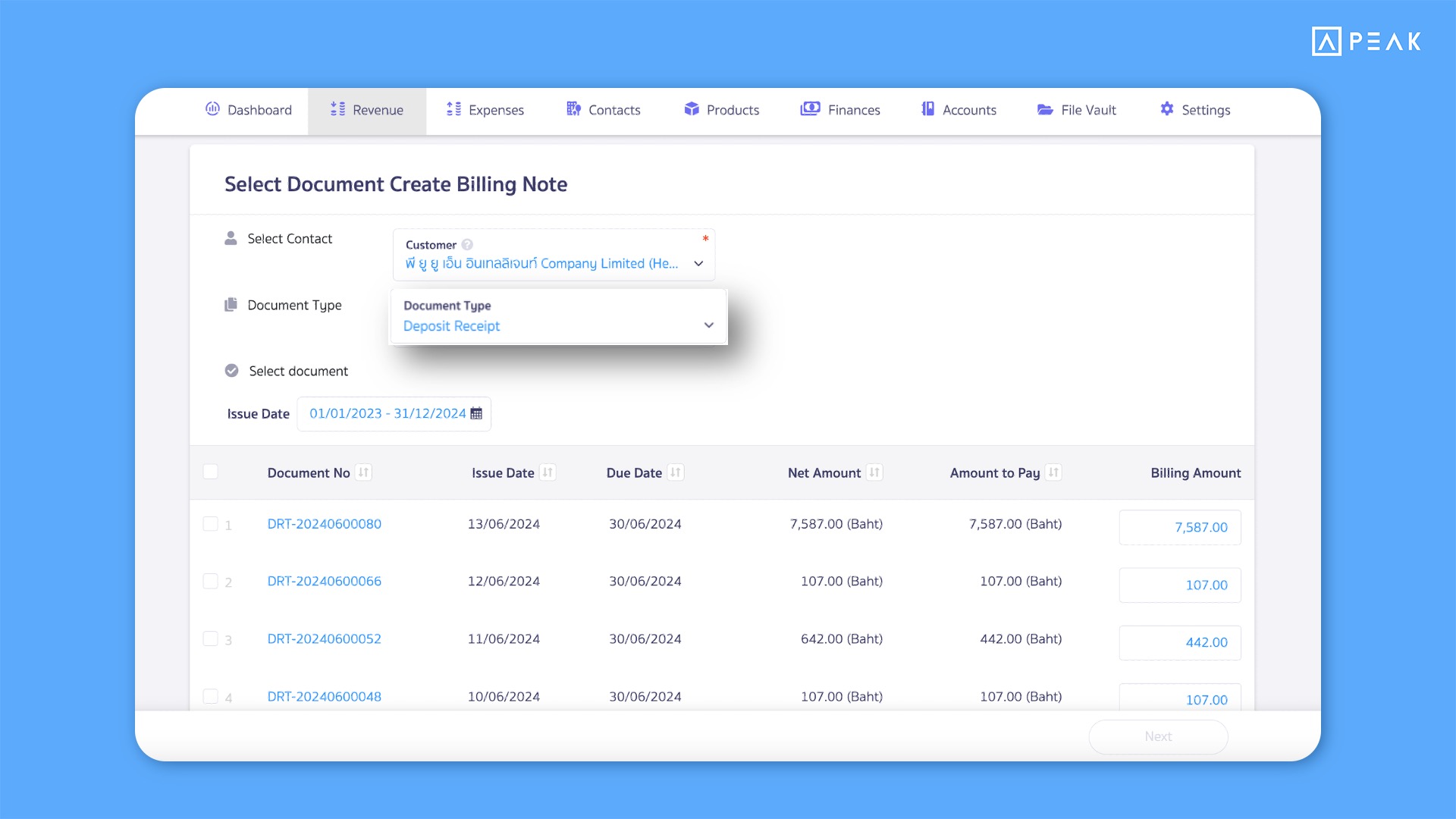

5.3 Facilitated the use of Deposit Receipts/Payments to generate Billing Note or Combined Payment Note.

📢Users can now directly generate Billing Note from Deposit Receipts and Combined Payment Note from Deposit Payments. This streamlines document management and improves organization. On the Billing Note/Combined Payment Note page (Online View), Deposit information will be displayed. Additionally, deposit details will be included in Billing Note and Combined Payment reports, enabling users to view and analyze data with greater accuracy and completeness.