PEAK with the new function designed to enhance efficiency.

✨ 1. AI has been added to recommend frequently used products/services and chart of accounts, helping to save time when recording documents.

📢 Suitable for businesses using the Pro Plus package, AI enhances accounting and inventory management efficiency. The AI system recommends accounts and products that match each business’s workflow, including frequently used items with specific contacts. This allows users to quickly select accounts or products without the need to search, saving time. This feature is displayed in the products/services and accounts sections for both income and expenses, with recommendations highlighted in purple. This functionality helps users save time and improves convenience, making accounting more efficient.

✨ 2. Added functionality for deposit receipts and deposit payment slips to speed up document management.

2.1 Print up to 20 documents simultaneously.

📢 Suitable for businesses that need to print multiple documents at once, this update allows deposit receipts and deposit payment slips to be printed for up to 20 entries at a time, helping to reduce the time spent on document management.

2.2 Added the ability to send documents via email.

📢 Designed for businesses that send documents via email, the deposit receipt page includes a button for sending documents through email. This feature helps reduce the use of paper documents and allows for quicker communication with partners by enabling the sending of documents or attachments via email.

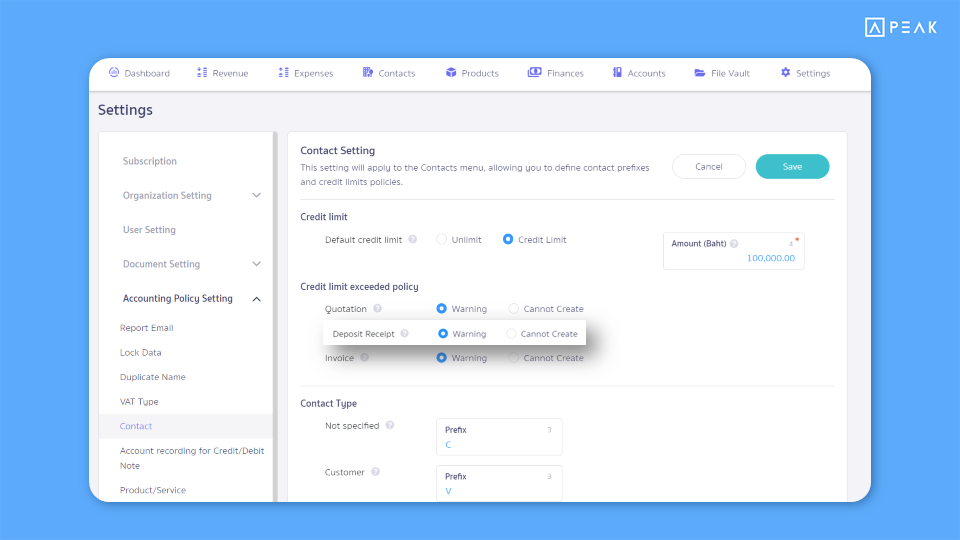

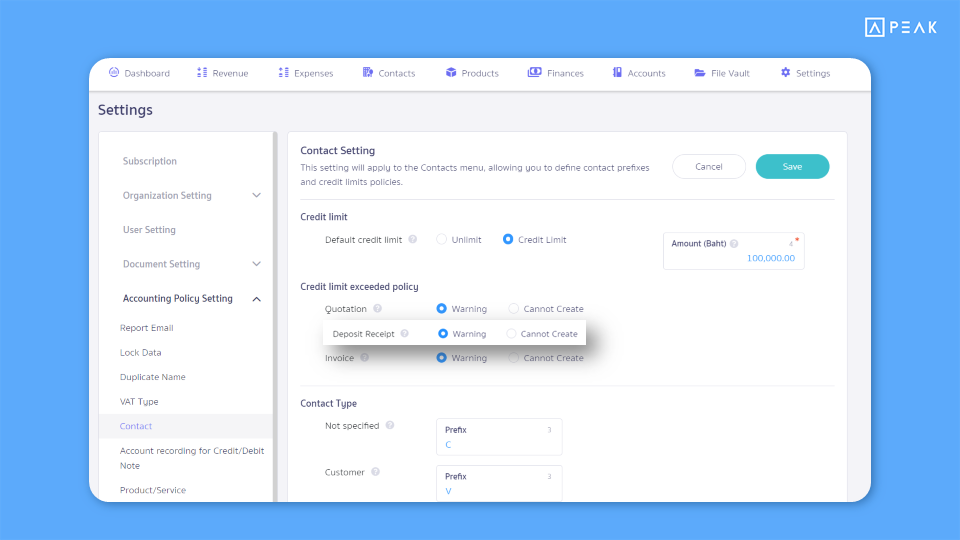

2.3 Added a notification setting for cases where a deposit receipt is created exceeding the set credit sales limit.

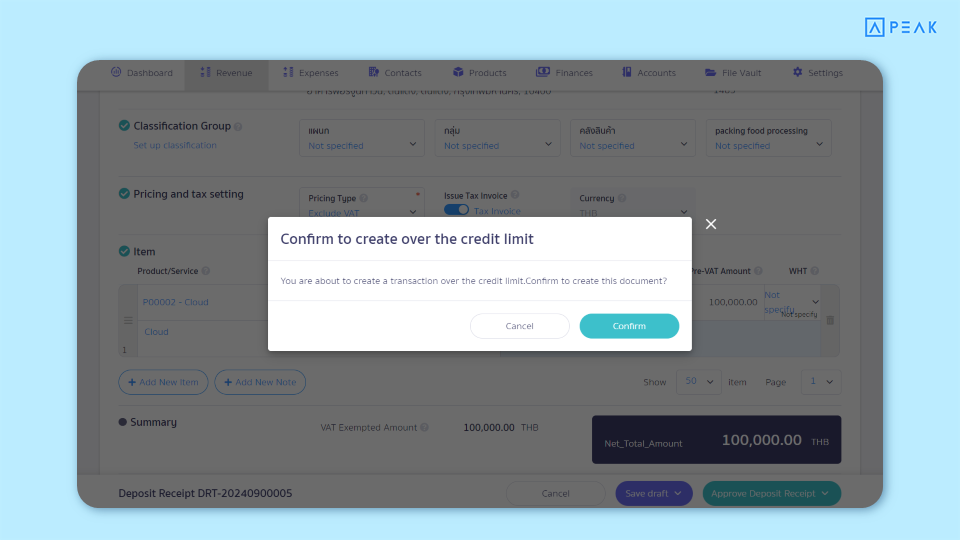

📢 Suitable for businesses that extend credit to clients, this feature allows users to set credit limits for each contact when issuing deposit receipts. This enables users to establish appropriate limits for each client. If a document is created with a total exceeding the set limit, the system will notify the user or prevent the creation of the deposit receipt. This enhances the efficiency of managing accounts receivable for the business.

Example of a notification when issuing a deposit receipt that exceeds the set credit limit:

✨ 3. Added a ‘Reversing Entries’ function at the end of the accounting period on the journal page, helping accountants work more efficiently.

📢Designed for accountants seeking flexibility in recording transactions, this feature allows users to reverse incorrect entries or make adjustments at the end of the accounting period, such as reversing accrued income or prepaid expenses. Users can easily reverse the recorded amounts, with the reverse button on the journal page functioning similarly to a copy feature, resulting in a new journal entry as follows:

- The system records as a general journal (JV).

- The debit and credit amounts are retained as original figures, but the system will swap the sides of the debit and credit.

- The system automatically adds a description stating ‘Reversal’ for the entries.

Documents with a reverse option must be in a pending review or approval status, enhancing convenience and reducing complexity in managing accounting documents.

✨ 4. Added a three-color flag display for verifying the totals of debit and credit, as well as for first-time usage of the chart of accounts in the trial balance.

📢Designed for accountants who need to verify balances in the trial balance, the system adds flag displays to alert users if there is a possibility of errors or items that require further review. The flags are displayed in three colors as follows:

- Green Flag: Indicates that the totals of debit and credit in the trial balance are matching (balanced).

- Red Flag: Indicates that the totals of debit and credit in the trial balance do not match (unbalanced).

- Orange Flag: Indicates that there are account items with changes for the first time, displayed according to the chart of accounts.

These features help ensure more efficient and accurate account verification.