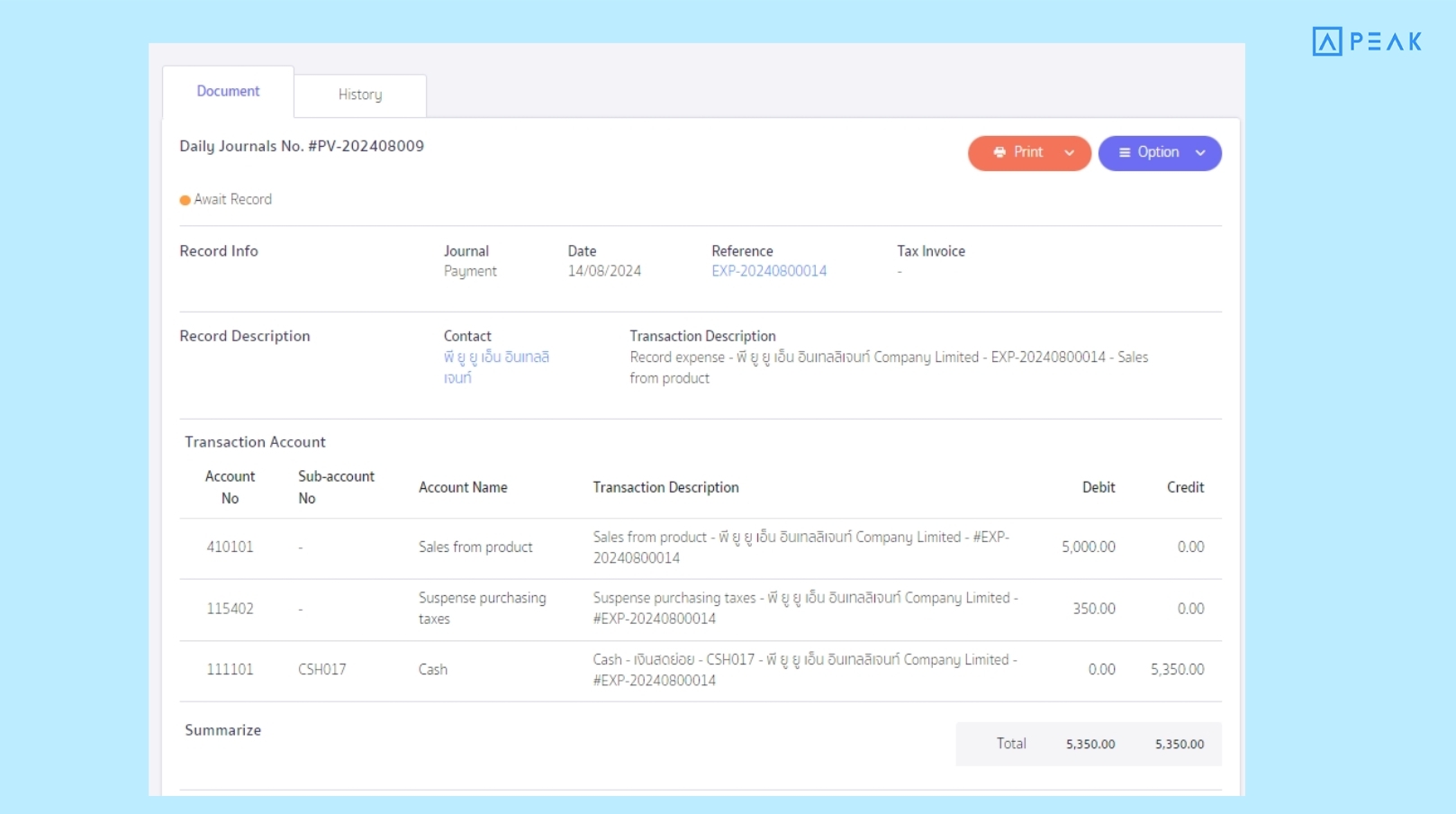

PEAK with the new function designed to enhance efficiency.

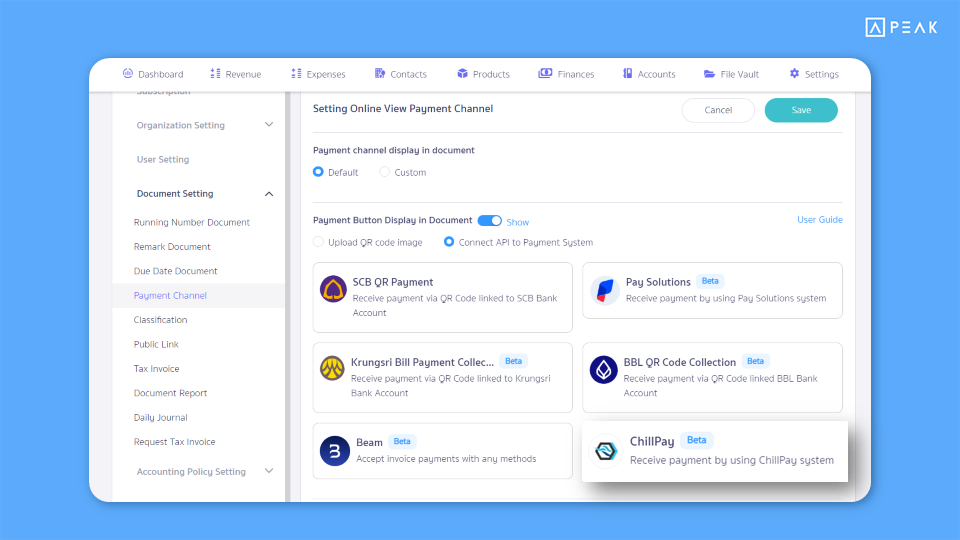

✨ 1. Integrate ChillPay Payment Collection to help businesses receive customer money through documents

📢 For businesses that want to make receiving payments from customers easier, this function makes receiving payments easy by connecting to various payment channels. Customers can choose to pay at their convenience, which reduces the steps of checking payments and recording data manually. The system will automatically update the payment status and generate a receipt, saving time and simplifying the work.

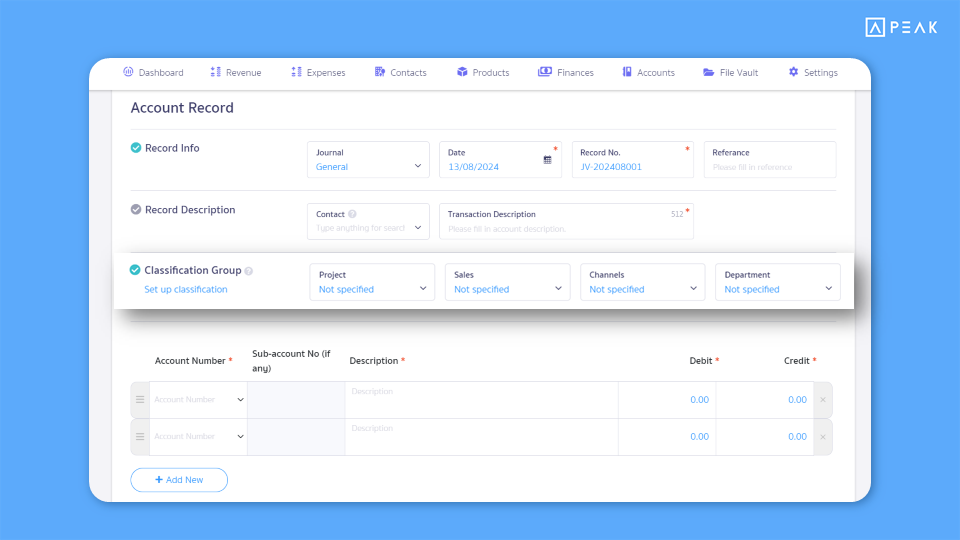

✨ 2. Added the function of selecting the classification group on the journal page

📢 For businesses using classification groups, you can now add and edit these groups directly from the journal entry page. Additionally, you can modify classification groups in journal entries created from source documents without affecting the original documents. This feature enhances user convenience and improves data management efficiency.

Thank you for the suggestion, K.Mananchaya, from N. B. ASSETS COMPANY LIMITED.

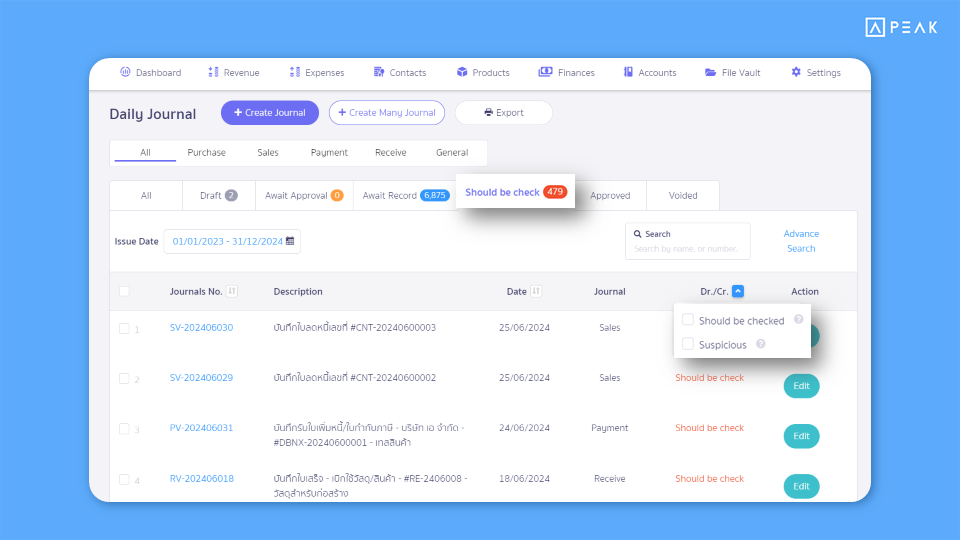

✨ 3. Added filtering for warning reasons that the status journal should check

📢 For business accountants, this function helps to make journal management more efficient by filtering the cause of alerts in the journal, allowing accountants to clearly distinguish between items that should be investigated and suspicious items and focus accountants directly on items that need to be investigated and corrected.

Examples of items that should be reviewed include journal entries with unmatched debit and credit amounts, entries without an account code, or entries with no amounts

Examples of suspicious items include a cash journal entry recording revenue, a sales journal entry recording expenses, or an incorrect sub-account selection in the chart of accounts