PEAK with the new function designed to enhance efficiency.

✨ 1. Added a function for recording receipts/payments to increase flexibility in recording income/expense transactions.

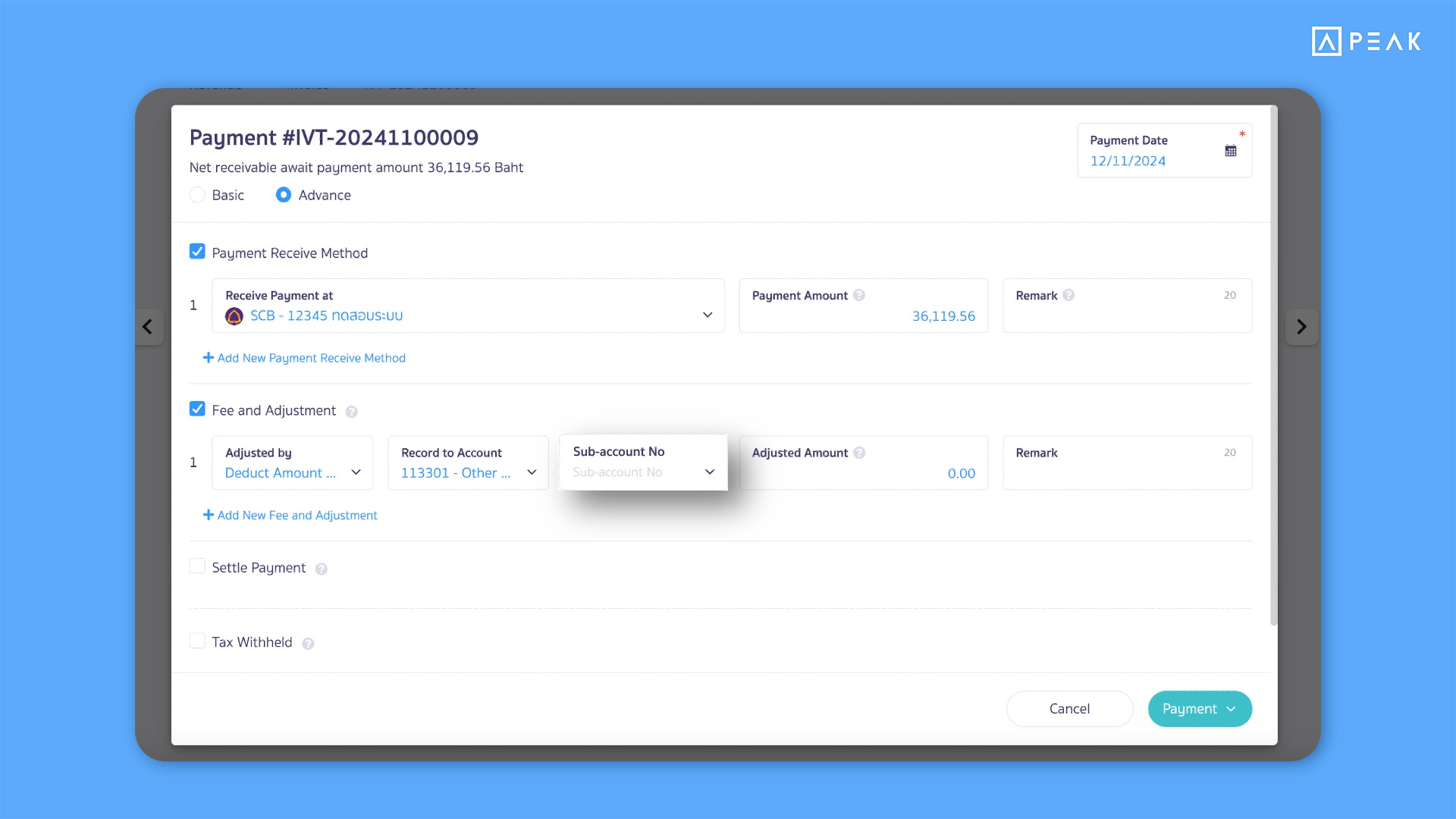

1.1 Added the option to select sub-accounts No for recording receipts/payments.

📢For businesses requiring detailed accounting adjustments, users can now record transactions by selecting sub-accounts No directly from the receipts/payments entry page. For applicable ledger accounts, such as Other Receivables or Other Payables, users can specify sub-accounts No, ensuring that journal entries are accurately and fully recorded in the appropriate sub-accounts. This feature streamlines the accounting adjustment process and enhances work convenience.

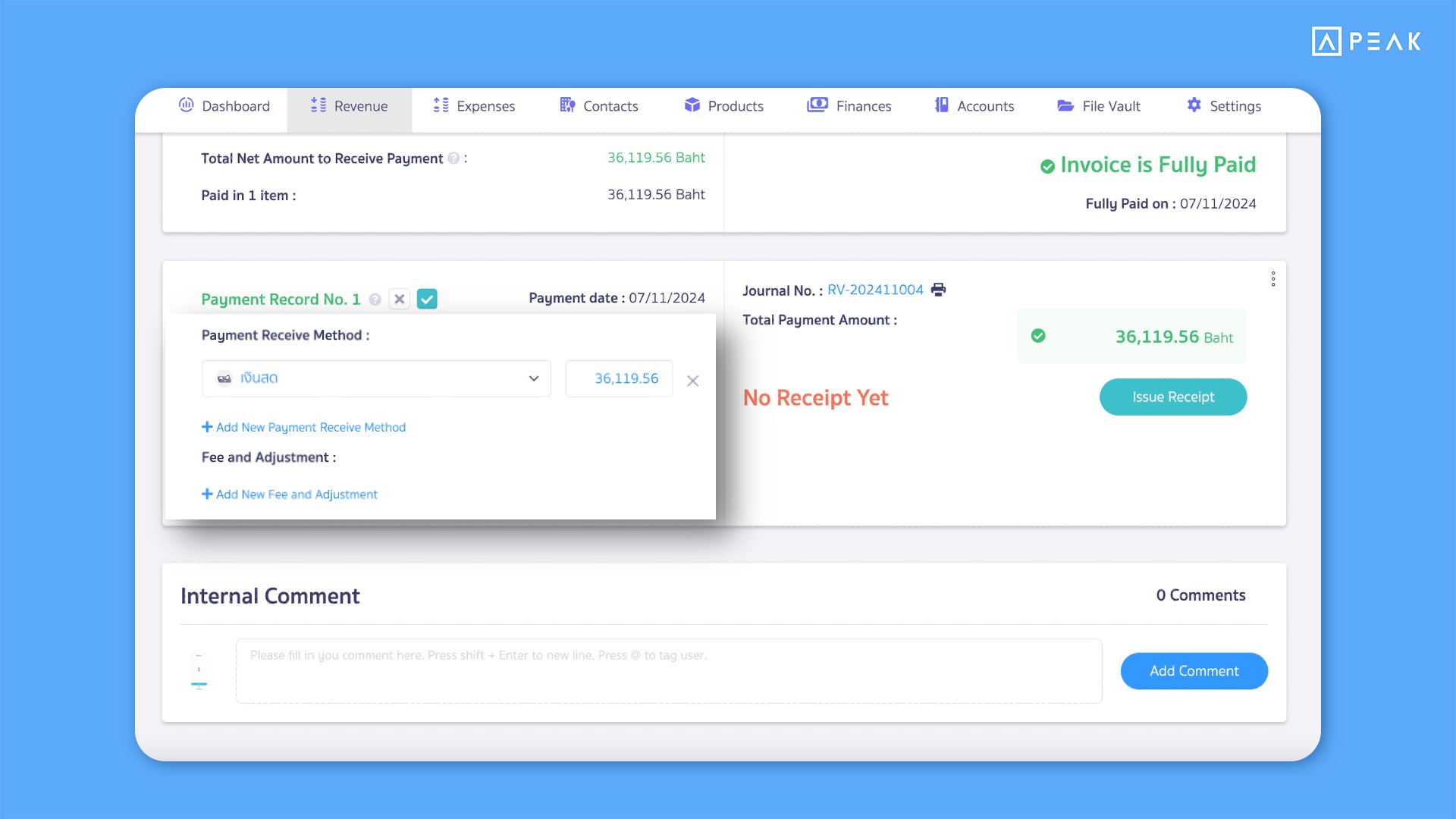

1.2 Added the ability to edit amounts, ledger accounts, and sub-accounts No.

📢For businesses seeking convenience in modifying receipt/payment entries, once a receipt/payment transaction is recorded, users can easily edit amounts and add or remove entries, provided the total amount remains consistent with the original. Additionally, users can select specific entries to adjust through the Easy Edit page, making data updates more convenient, complete, and accurate.

Note: Editing is not available for receipt/payment transactions made by check.

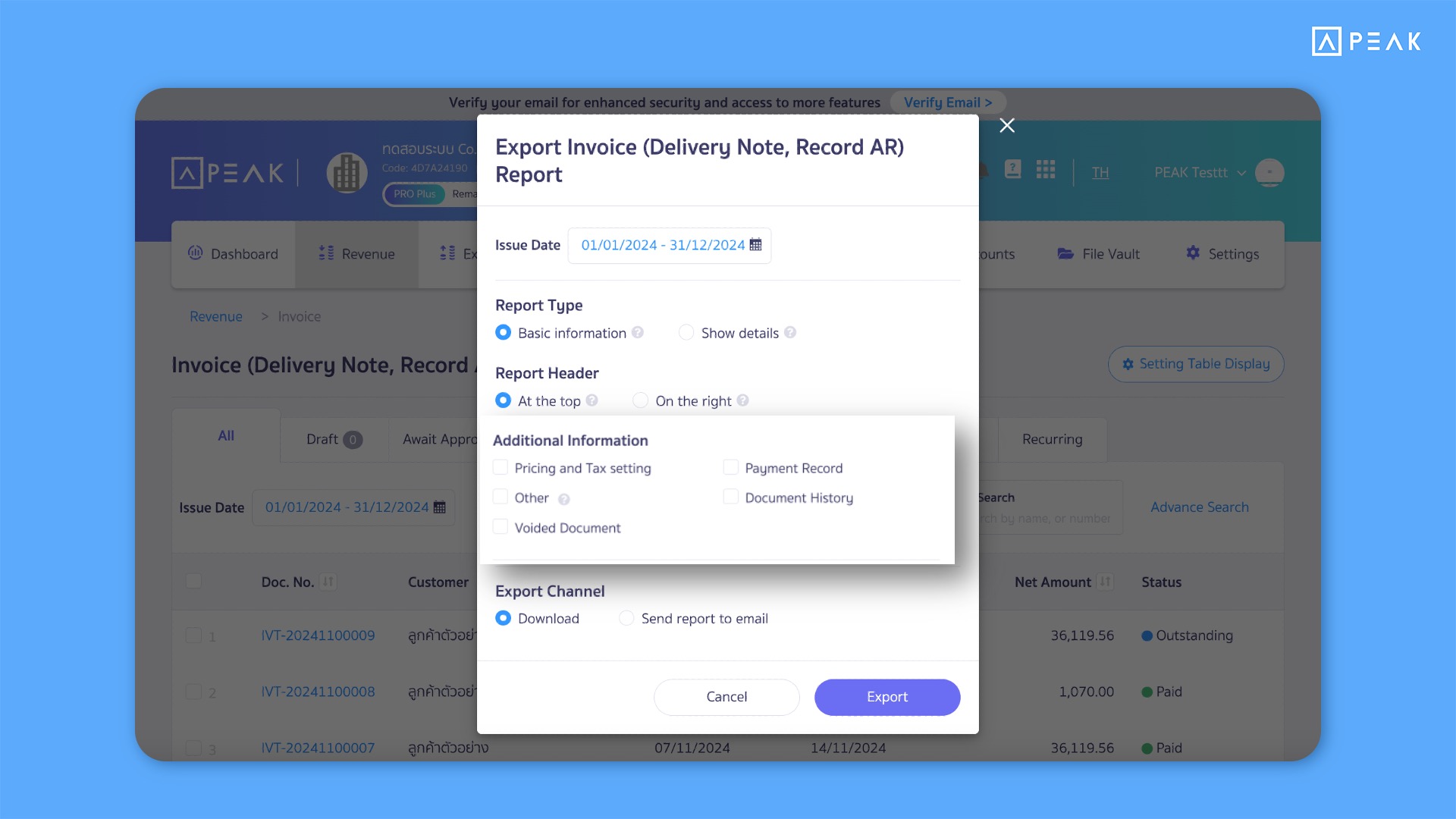

✨ 2. Added an option to customize data display in income and expense report documents, allowing for flexible report formatting as needed.

📢For businesses needing to print income/expense report documents, users can customize the report format and select data display options to suit their needs, providing more comprehensive details such as currency, exchange rates, payment/receipt channels, information on the document creator and approver, classification groups, and deposit deductions.This customization ensures that the report aligns with the specific data requirements.

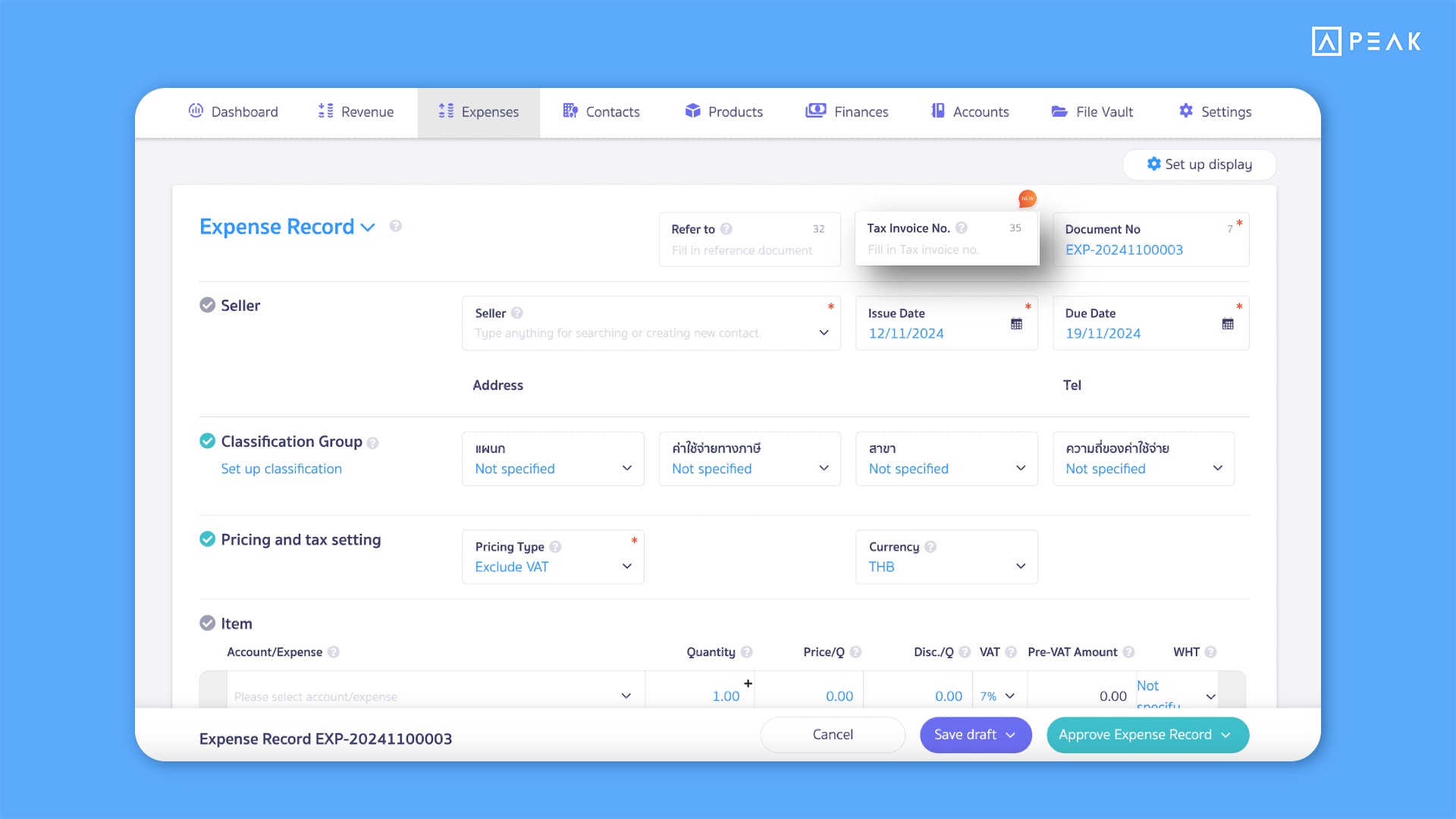

✨ 3. Adjusted the tax invoice registration field and added a date field for tax invoices to facilitate easier data entry and tracking of tax record entries.

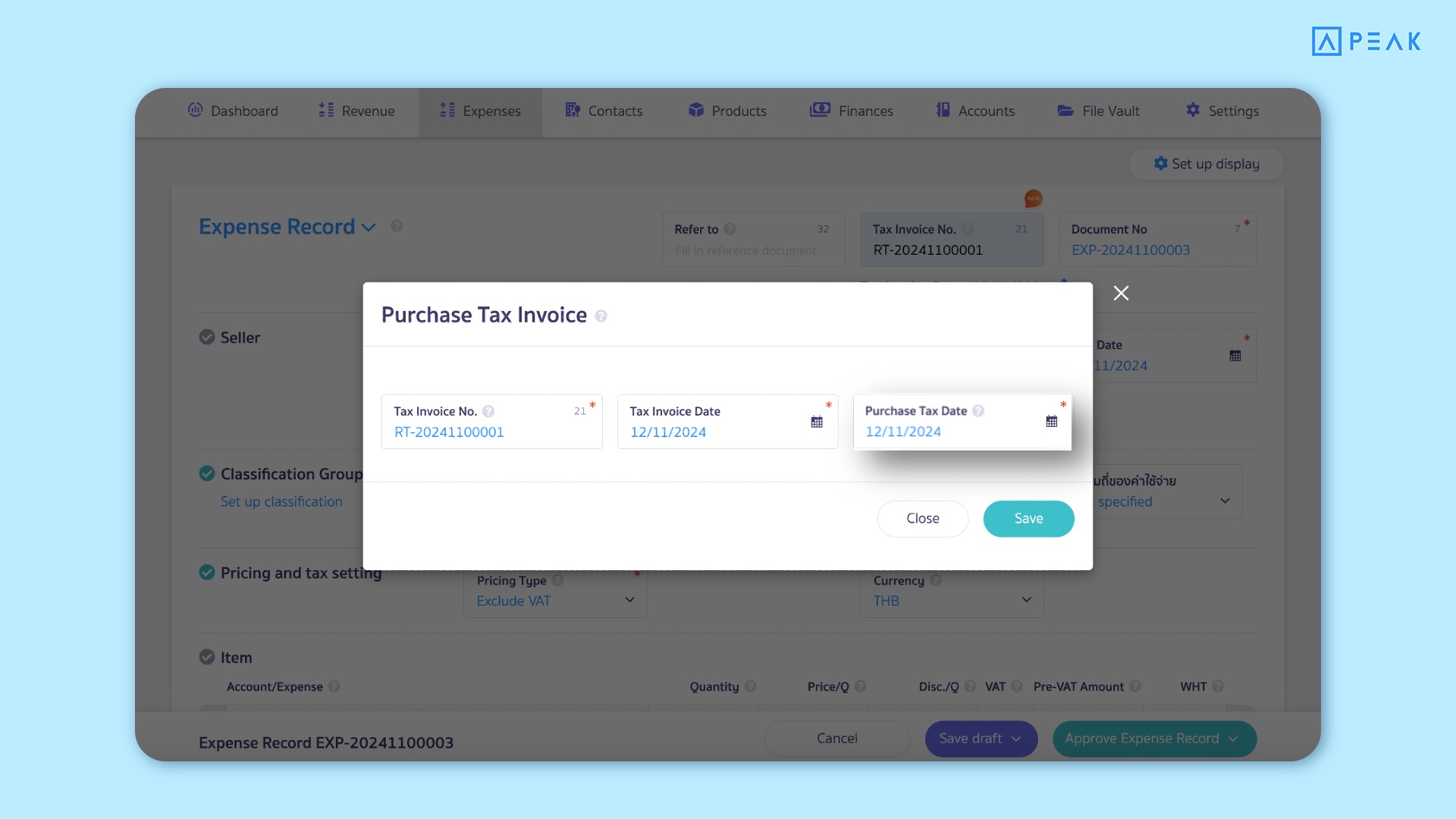

📢For businesses that need to register tax invoices, the system has updated the tax invoice registration process as follows:

- The position of the tax invoice registration field has been changed.

- The text has been updated from “Add Tax Invoice” to “Tax Invoice Information.”

- A “Purchase Tax Record Date” field has been added, allowing the system to reverse the purchase tax entry based on the desired date.

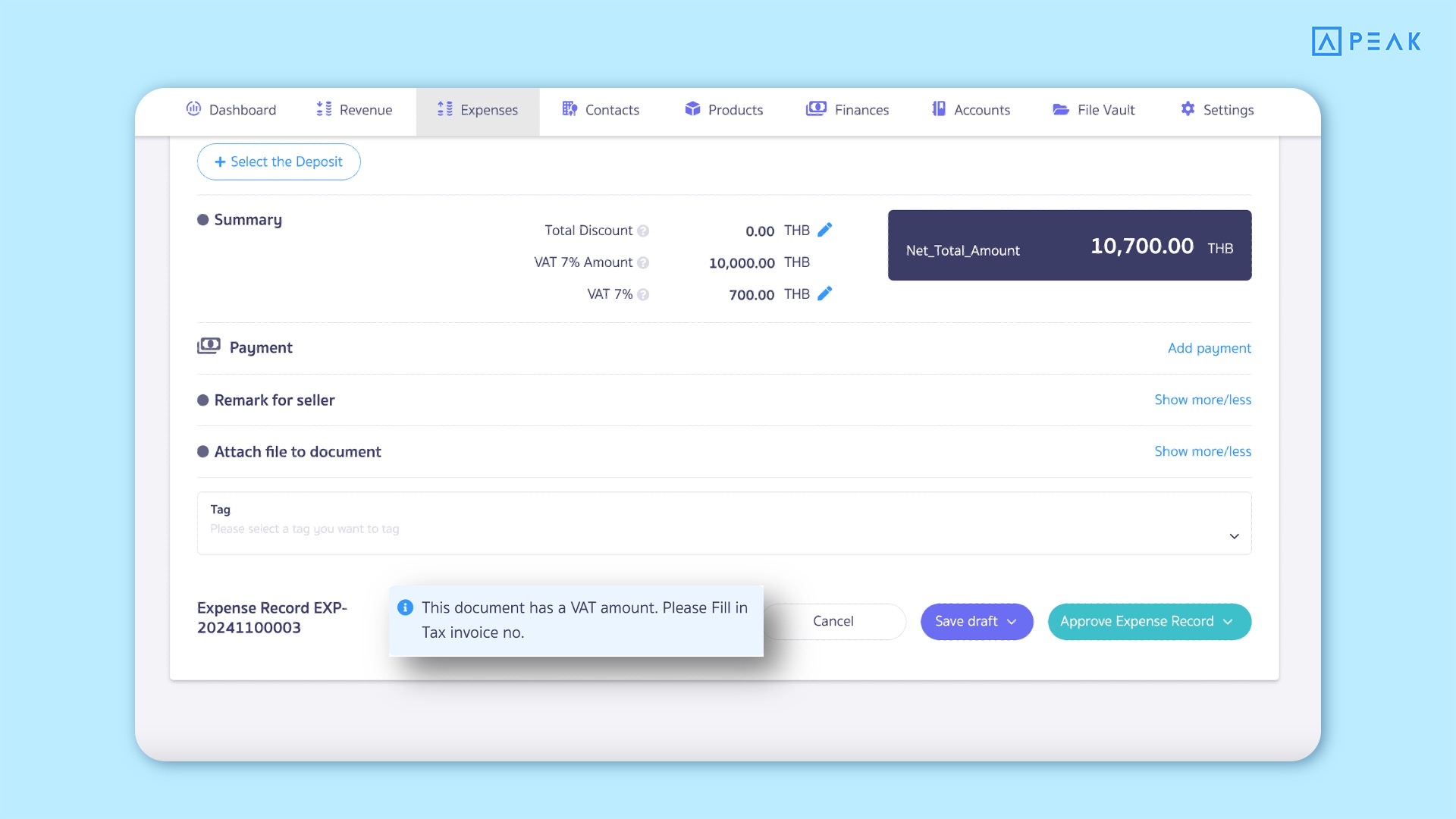

Additionally, if a document is created without specifying a tax invoice, the system will automatically notify the user on the document page, enhancing the efficiency and convenience of data entry.

Example of the Tax Invoice Information Page.

Example of a notification when a document is created without specifying a tax invoice.

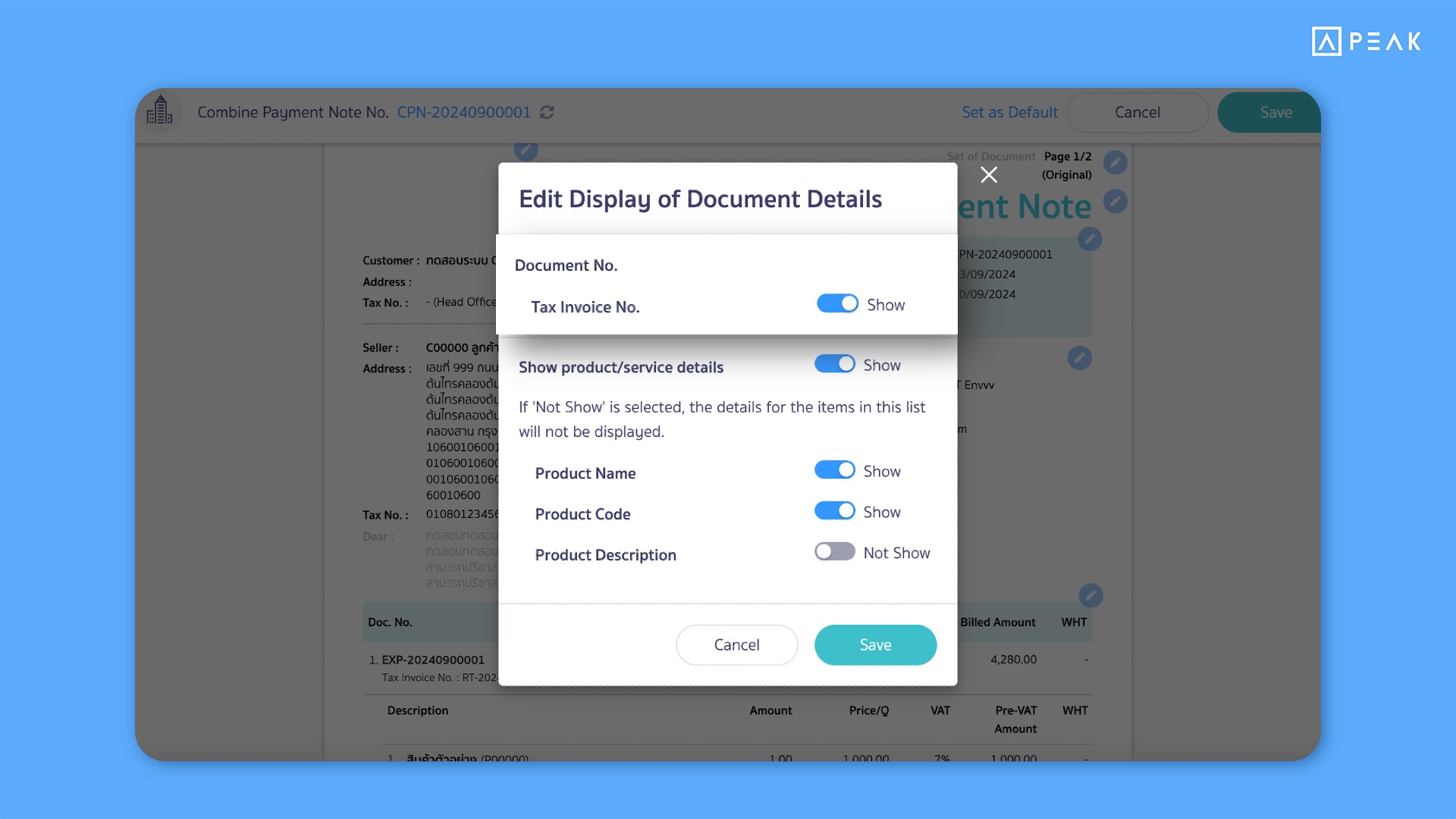

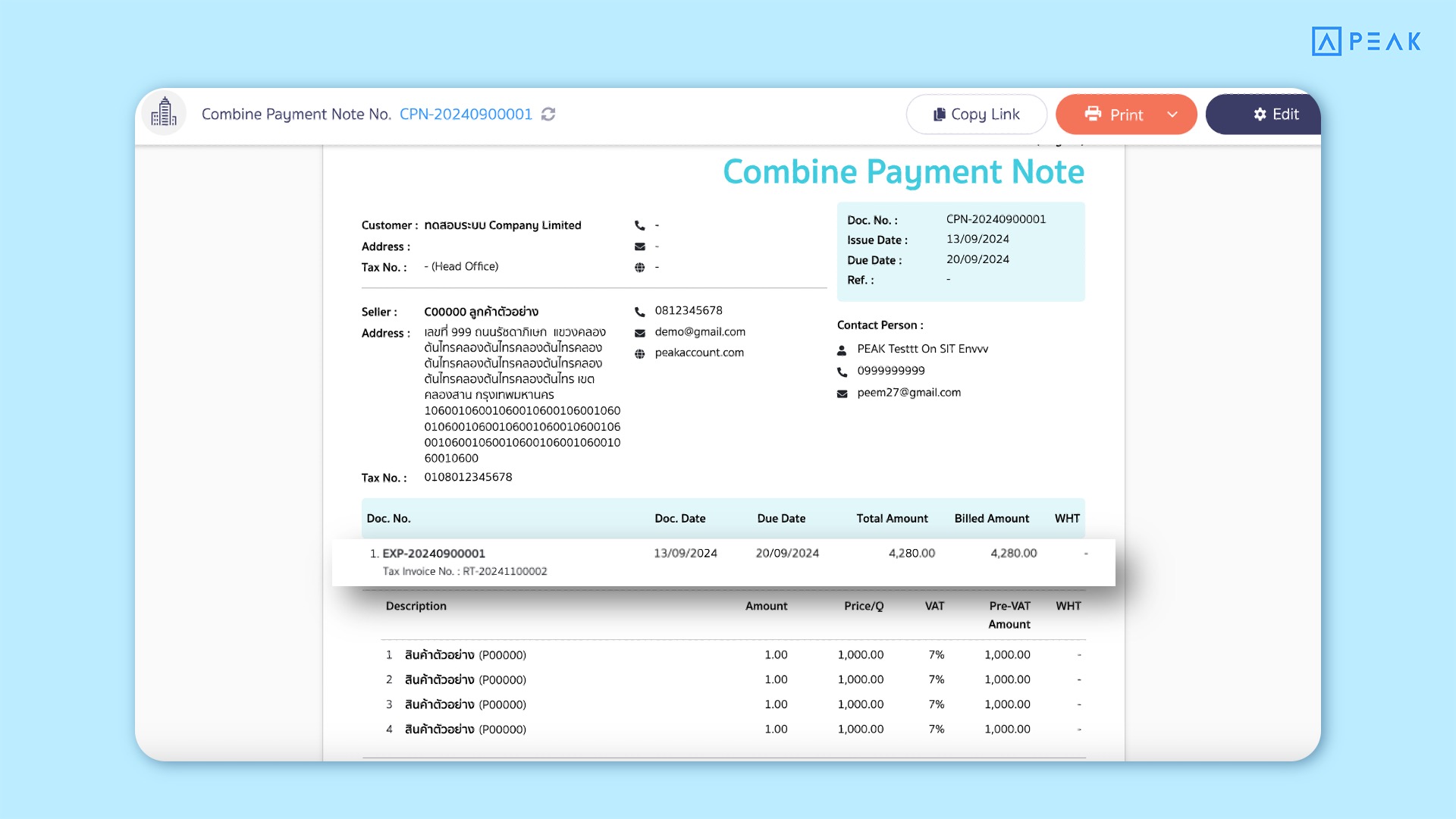

✨ 4. Added the display of “Tax Invoice Number” on the combined payment document page (Online View) to enhance the convenience of data verification.

📢For businesses using the Pro and PRO Plus packages, if you want to view the tax invoice number details on the combined payment document page (Online View), users can choose to display or hide the tax invoice number as needed. This feature helps make the tax invoice verification process more convenient.

Example of displaying the tax invoice number on the document page (Online View).

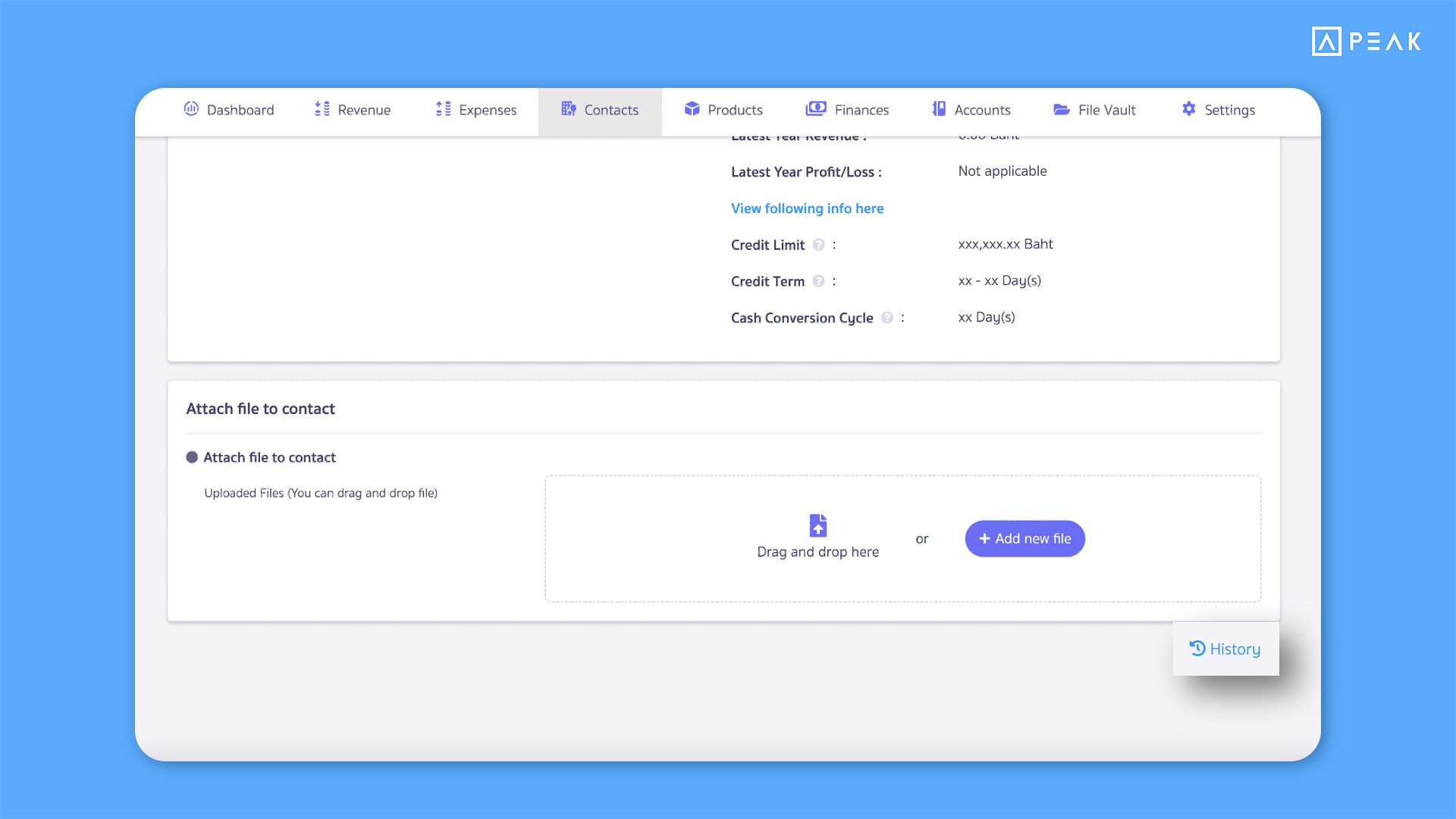

✨ 5. Added the ability to view the usage history for each contact, making it easier to track data modifications.

📢For businesses that need to view usage history, the system will display the activity related to each contact on the contact page. This includes actions such as creating contacts, editing, enabling/disabling access, and attaching files, whether from the website or via API integration. The system will show all relevant activity for the contact, with data available for up to 5 years, allowing users to easily track the reasons behind data modifications.

Thank you for the suggestion by K.Kamonthip from Sellsuki Co., Ltd.