PEAK with the new function designed to enhance efficiency.

✨ 1. Developed the bank reconciliation function to enhance work efficiency and convenience.

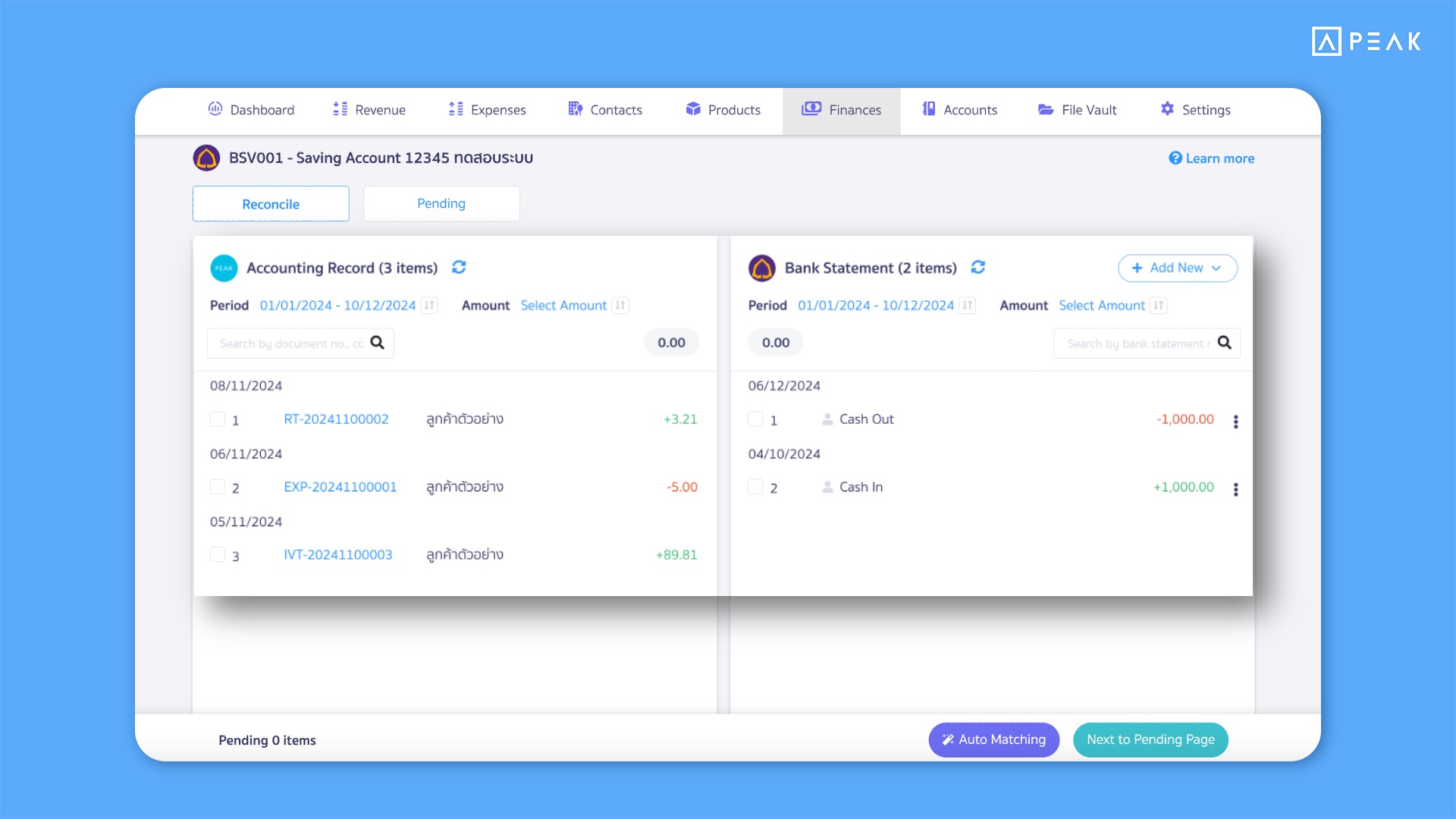

1.1 Improved the display of information on the reconciliation page for better readability.

📢 For businesses using the bank reconciliation function, the system has been updated to enhance the display on the reconciliation page, allowing more information to be shown. The updates include:

- Grouping transactions with the same date together

- Adding Check Box for selecting items

- Displaying contact details on the same line as the document number

- Showing logos (if available)

These improvements aim to boost efficiency and make data review more convenient and faster.

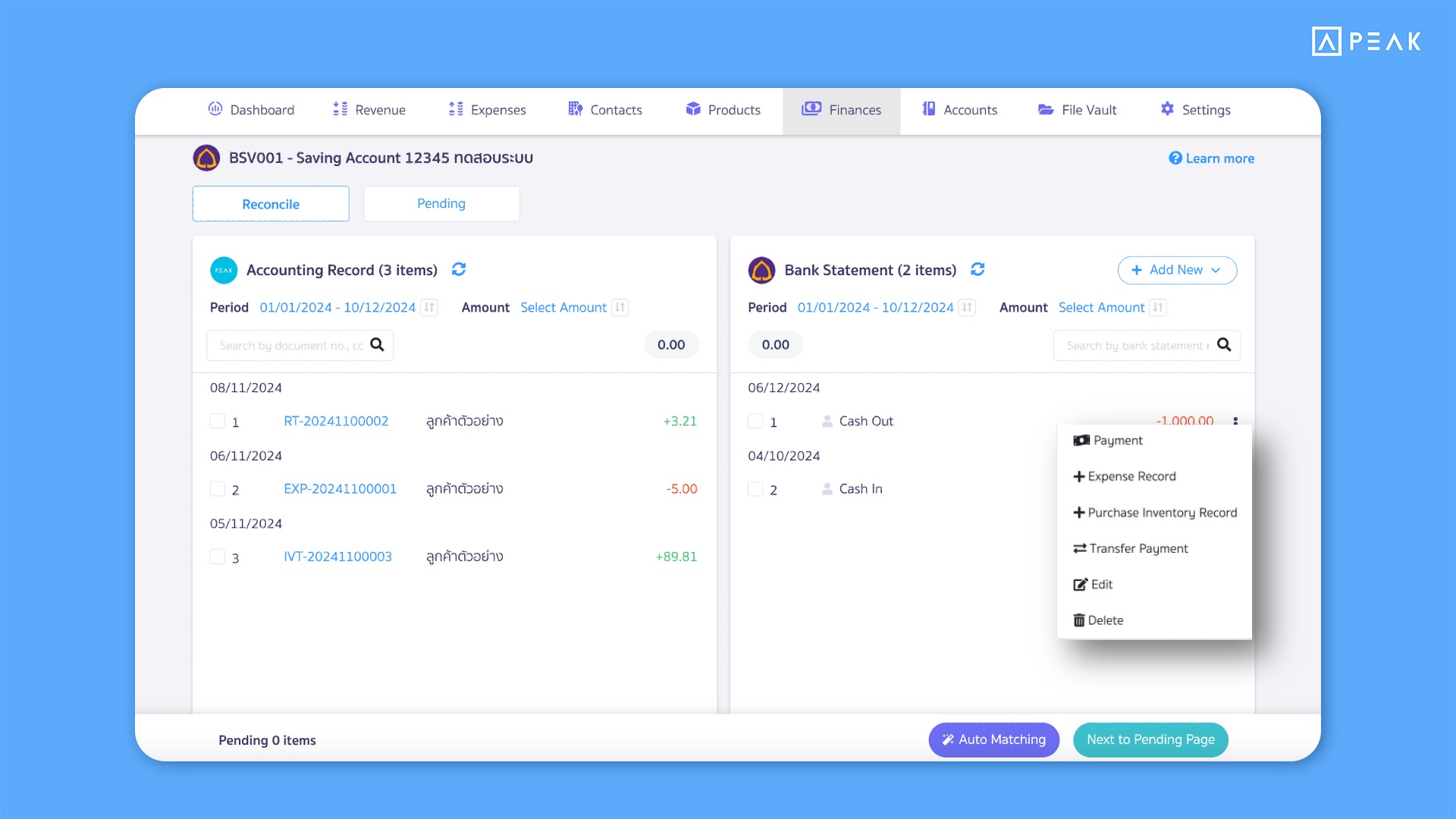

1.2 Ability to create new transactions directly from the reconciliation page.

📢 For businesses using the Premium, PRO Plus, and Trial packages, that perform bank reconciliation and need to make transactions, the system now offers additional options to create transactions directly from each deposit/payment entry. Users can click the options button (three dots) or right-click to perform actions immediately through the bank reconciliation page. The available options include:

- Creating documents

- Recording payments/receipts

- Transferring funds from reconciliation transactions

- Editing or deleting transactions

These features are designed to streamline document management and enhance efficiency in bank reconciliation processes.

✨ 2. Added the PEAK Payroll system to streamline payroll processing and reduce manual steps.

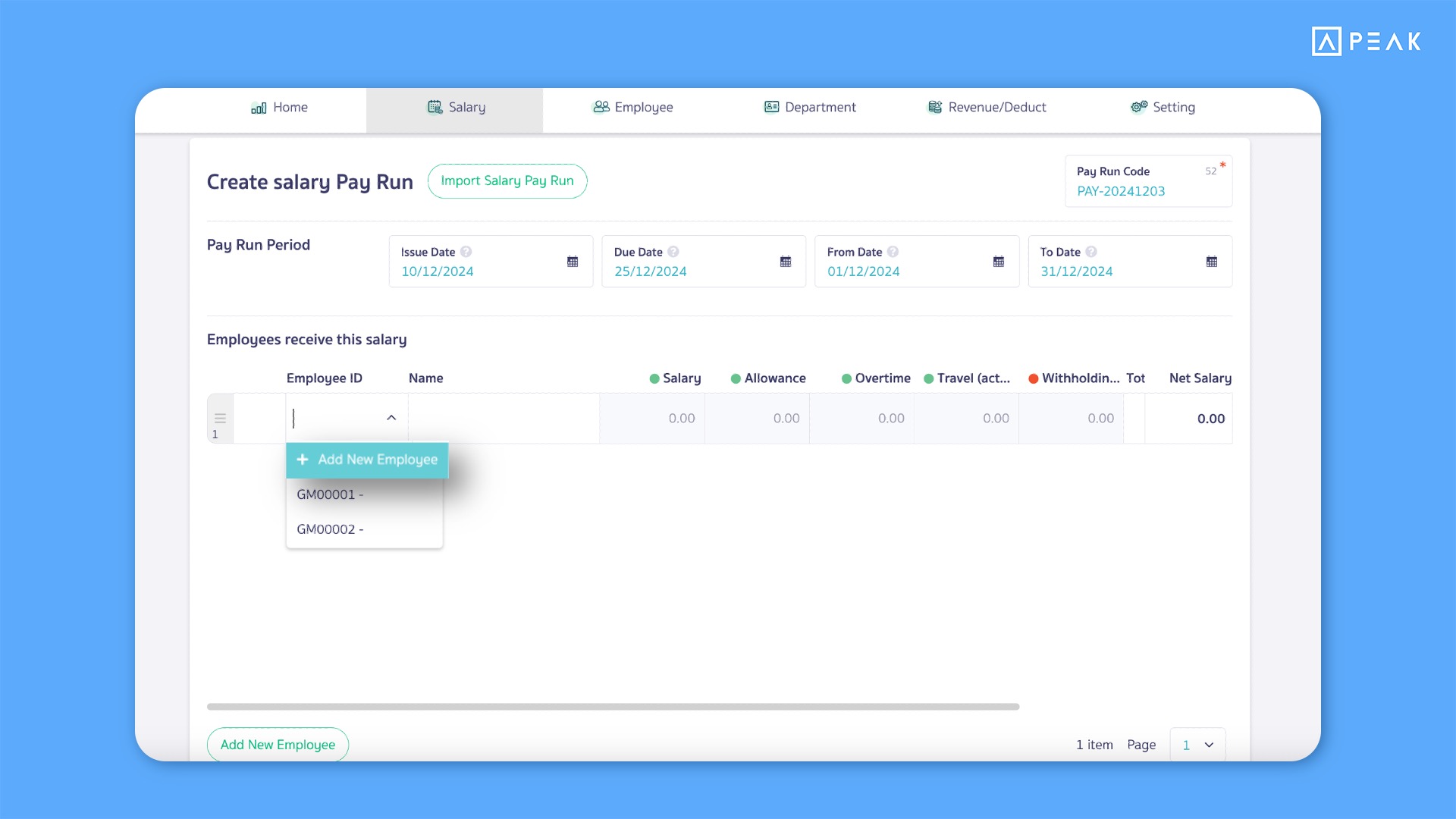

2.1 Add new employees directly on the payroll processing page.

📢 The system now includes an “Add New Employee” button on the payroll processing page. Users can conveniently add new employee information directly from the payroll page, streamlining the workflow and improving efficiency.

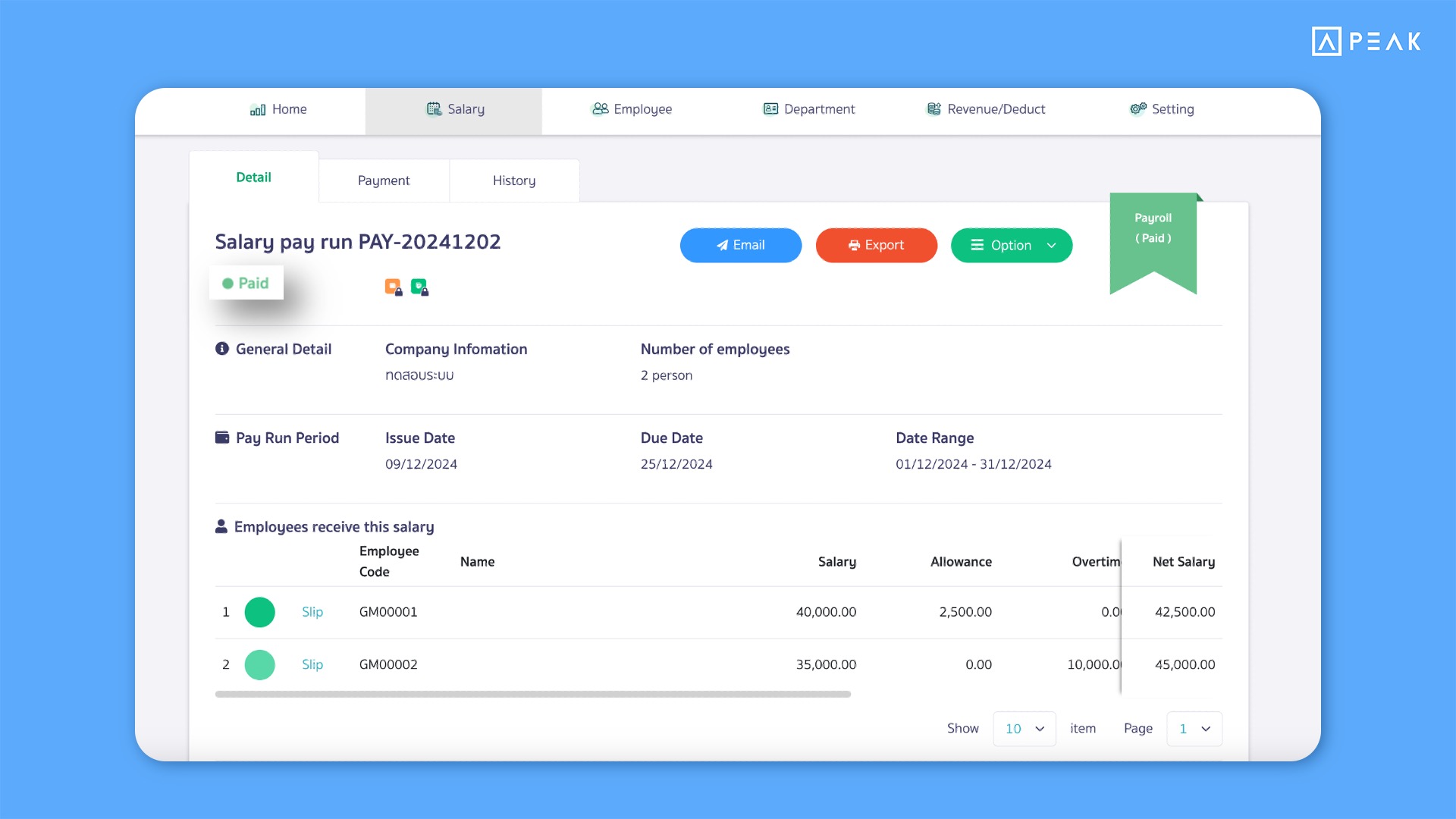

2.2 Adjust accumulated income calculations to be based on a cash basis.

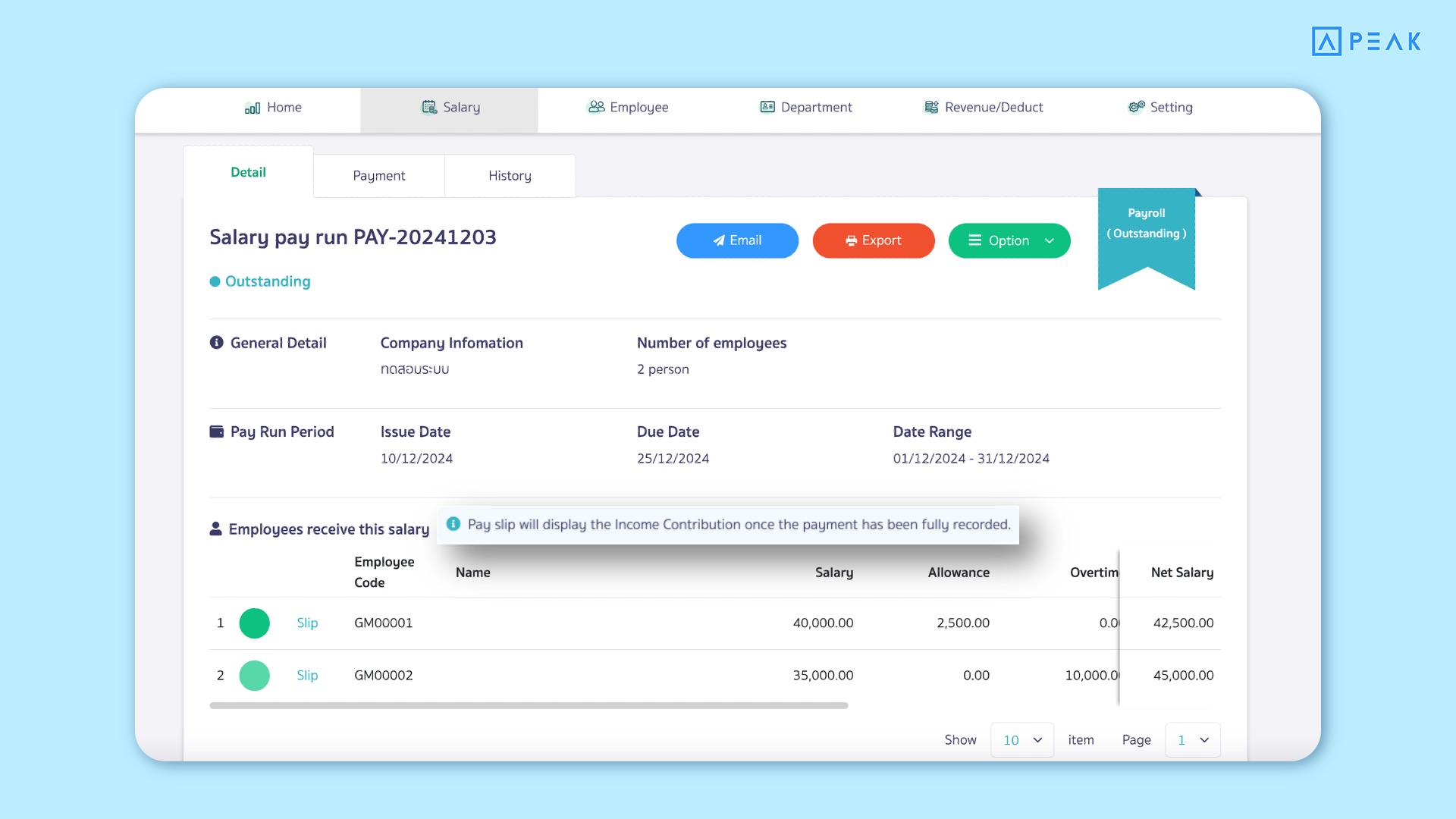

📢 The system now adjusts the calculation of accumulated income displayed on payroll slips. It will calculate based only on payroll payment documents with a “Paid” status. Additionally, a notification has been added to the payroll payment page to inform users about the new calculation criteria. This enhancement ensures that the information is accurate and aligns more closely with the cash-based principle.

Example of a Notification Regarding Cumulative Income Calculation.

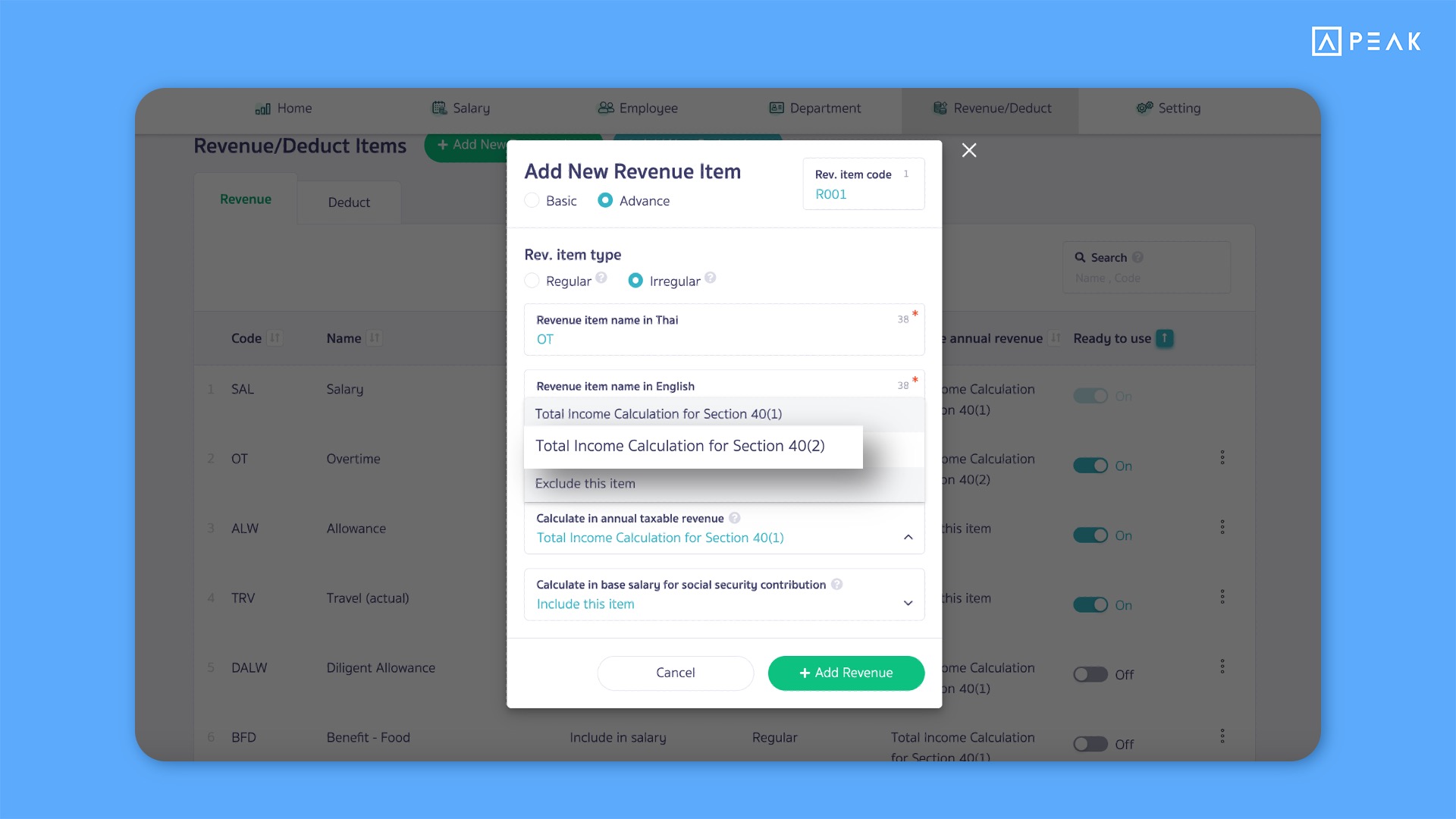

2.3 Add the option “Income Type 40(2)” on the additional income adjustment page and display it in Form 50 Bis on the payroll summary page.

📢 The system now includes an option for income type 40(2) on the Additional Income page. Users can edit each additional income item by specifying whether it falls under income type 40(1) or 40(2). When generating the year-end payroll summary, the system will automatically pull the data and display income type 40(2) items on the Withholding Tax Certificate (Form 50 Bis) page.

This enhancement ensures greater accuracy in managing tax data.

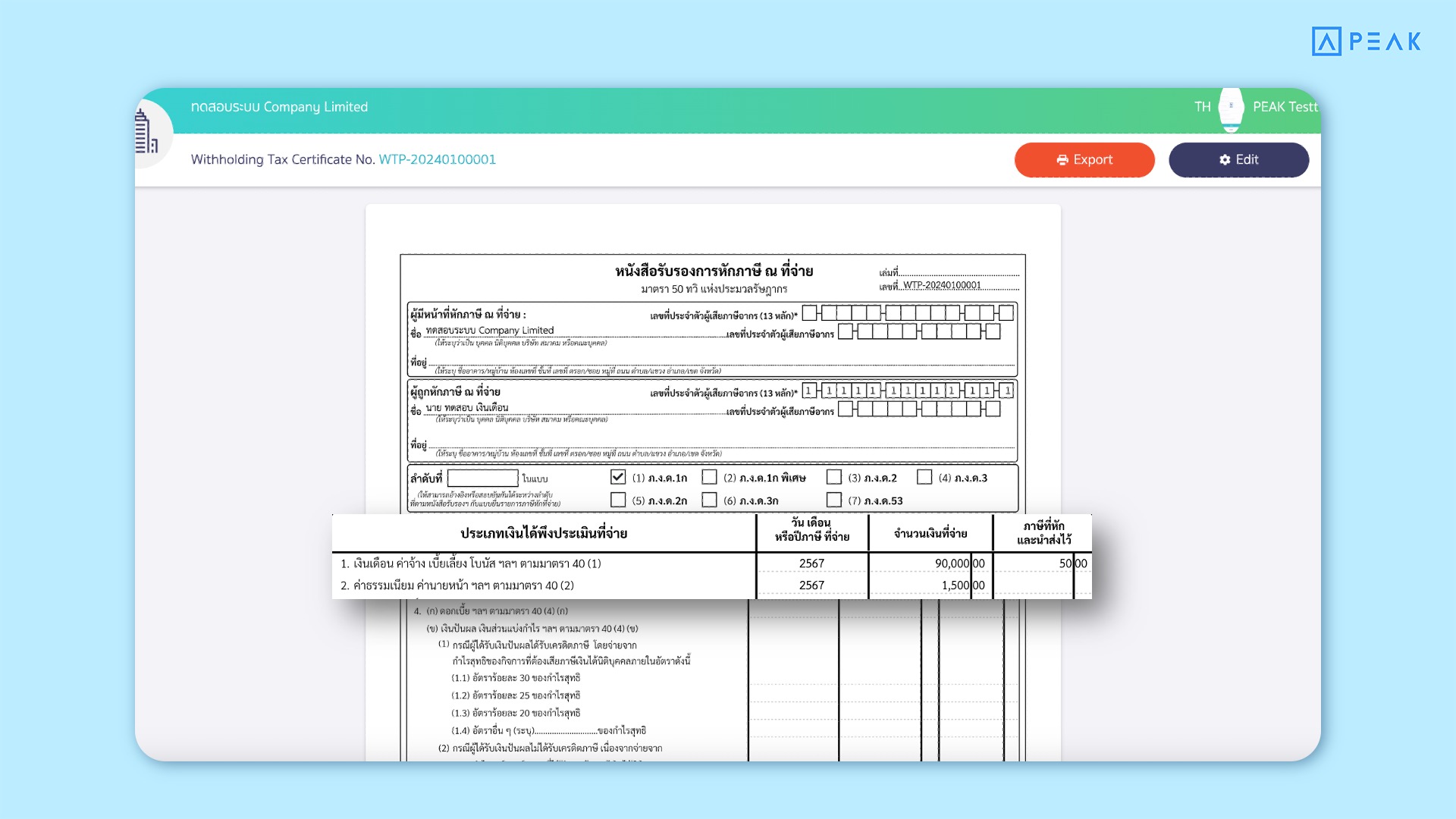

Example of Form 50 Bis with income type 40(2).

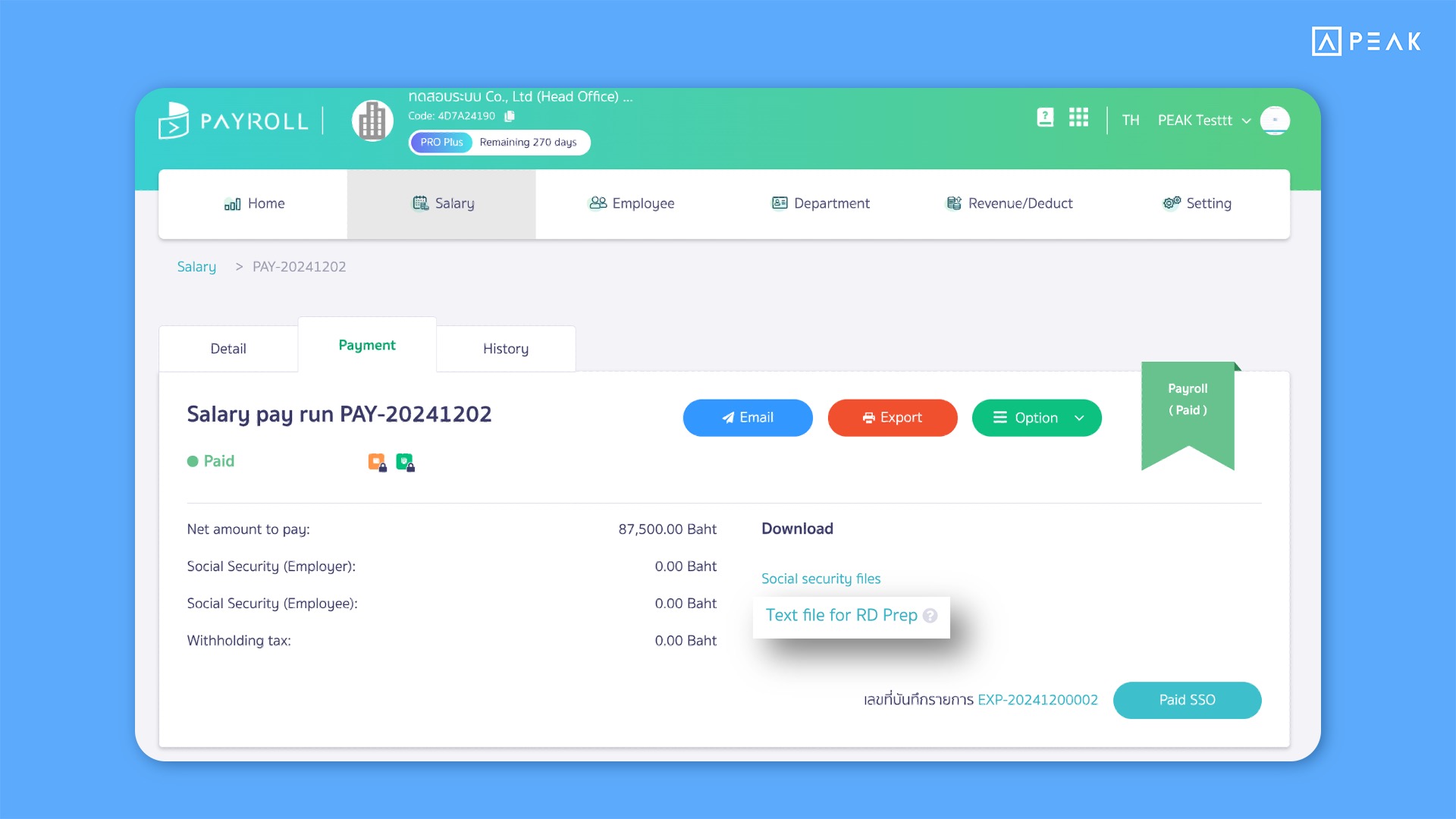

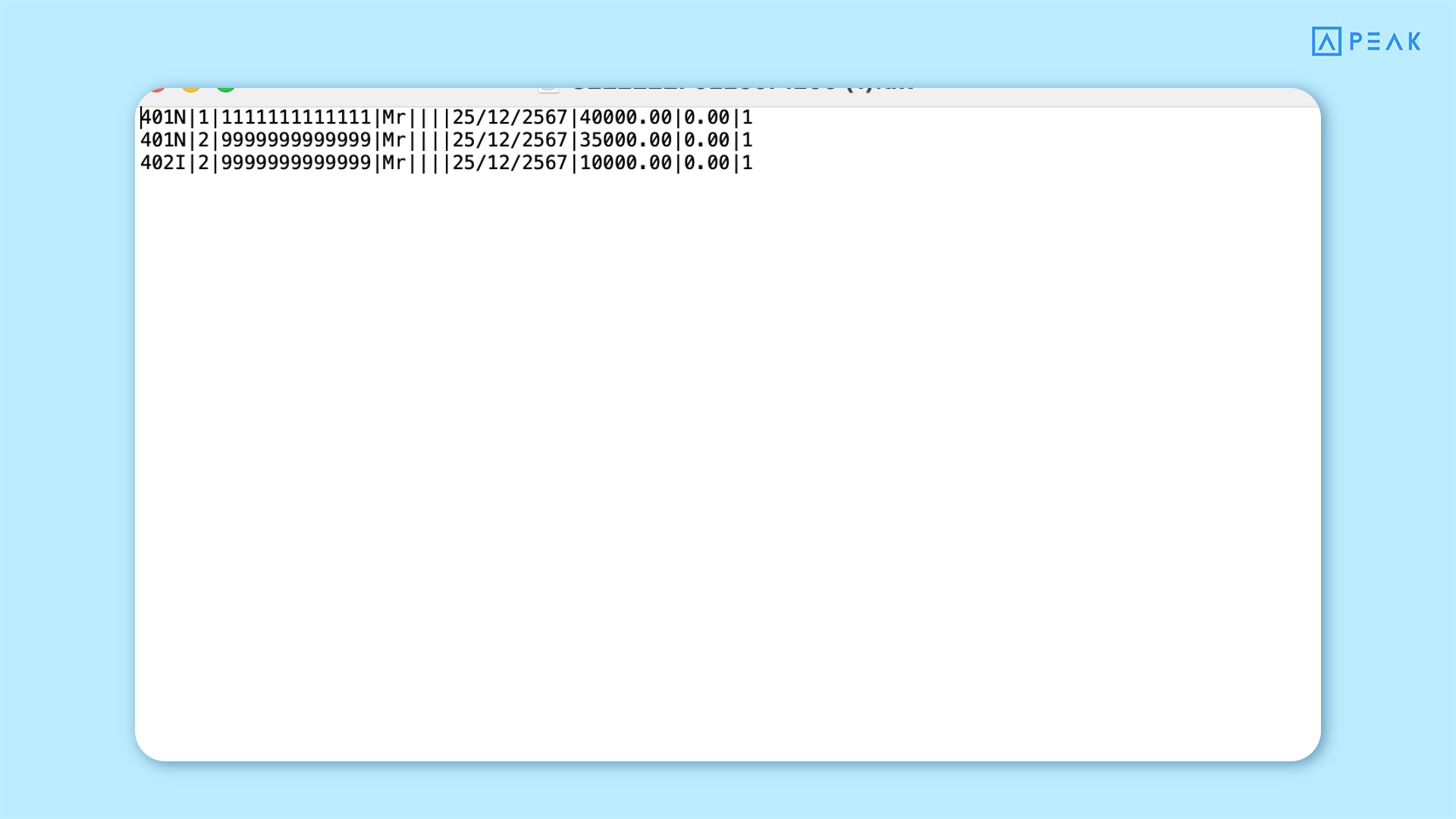

2.4 Support displaying “Income Type 40(2)” in the tax submission file. (PND.1 Text File)

📢 The system now updates the tax filing Text File for P.N.D. 1 to support income type 40(2) in addition to 40(1). This improvement enables users to file taxes more conveniently and accurately by including both income types in the submission.

Example of a Text File with income type 40(2).

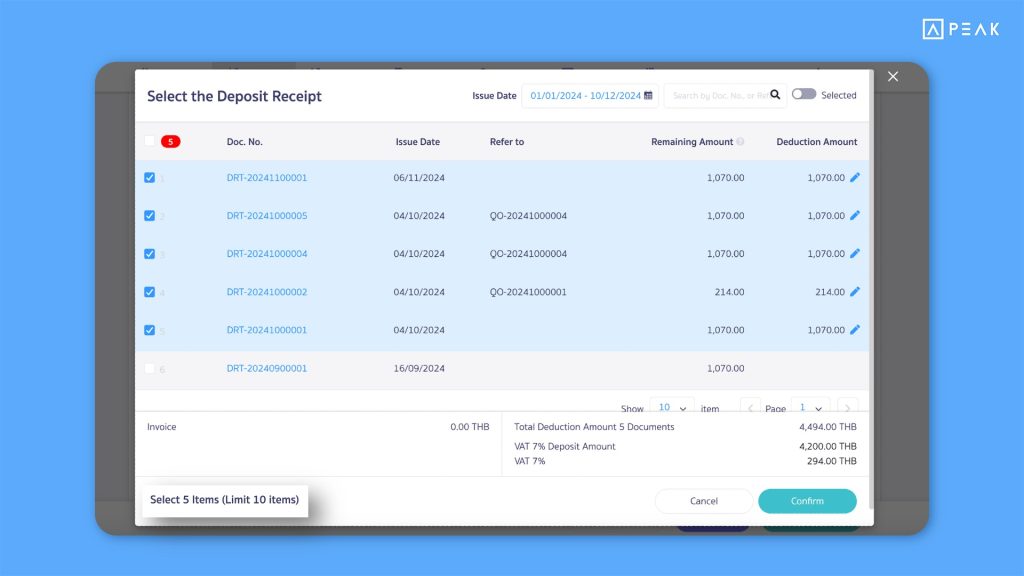

✨ 3. Developed the functionality to apply deposit receipts/payments for settling more than one document.

📢 For businesses using deposit receipts/payments, the system now supports applying these documents to offset payment/receipt transactions. Users can choose to apply deposit receipts/payments in two ways:

- One to Many (1 to Many): A single deposit receipt/payment can be applied to offset multiple transactions (up to 10 items per session).

- Many to One (Many to 1): A single transaction can be offset using multiple deposit receipts/payments.

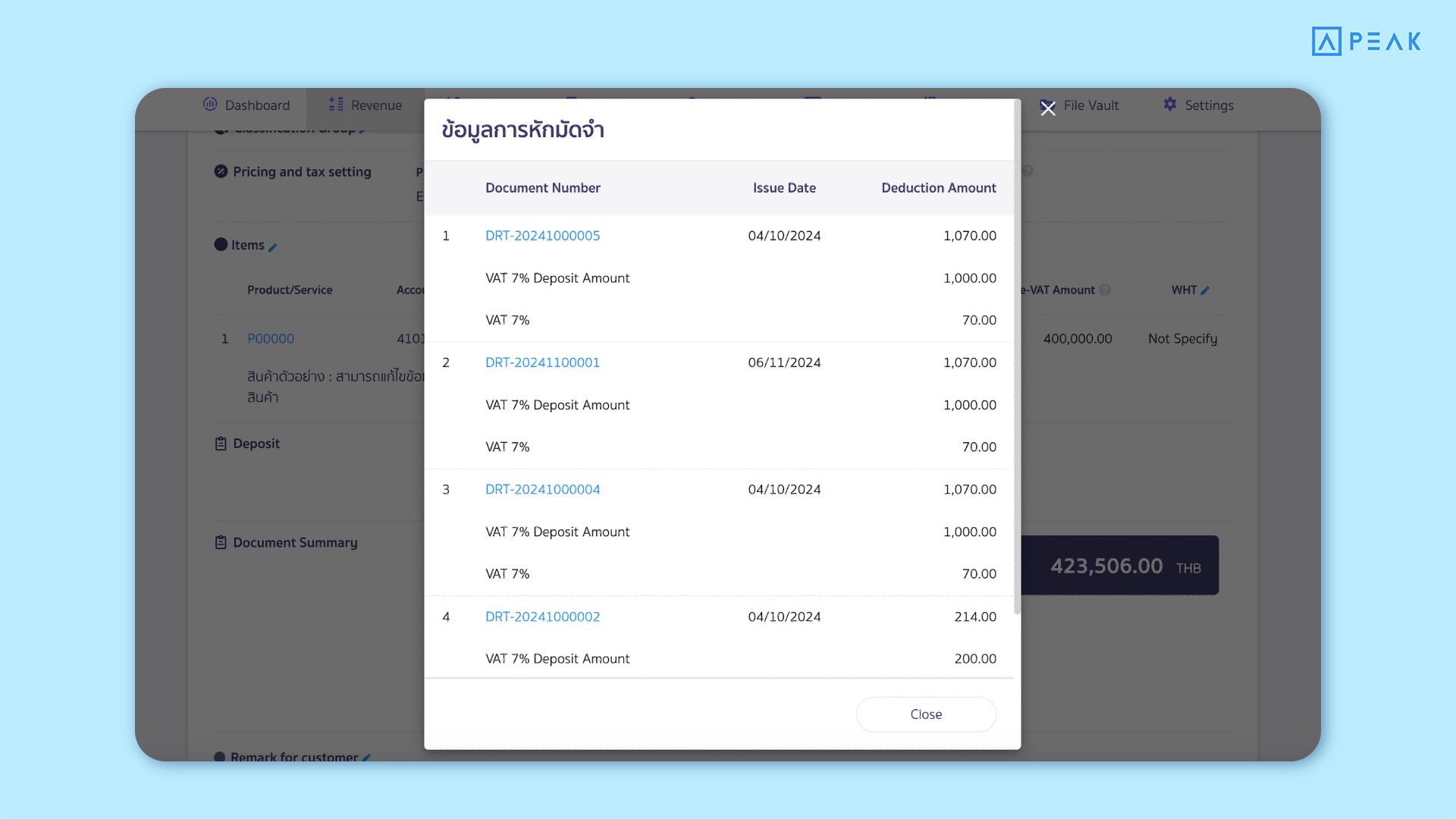

When selecting deposit receipts/payments for offsetting, users can modify the amount and related tax values. On the deposit details page, the system will display the number of deposit documents applied for offsetting, the applied amounts, and the remaining deposit balance for future use.

For example, if a deposit receipt is issued and the customer makes partial payments in multiple installments, the system will accurately track these payments.

This feature enhances convenience and flexibility in managing deposit receipts and offsetting payments, ensuring efficient financial operations.

Example of Deposit Information Display on the Document Page.

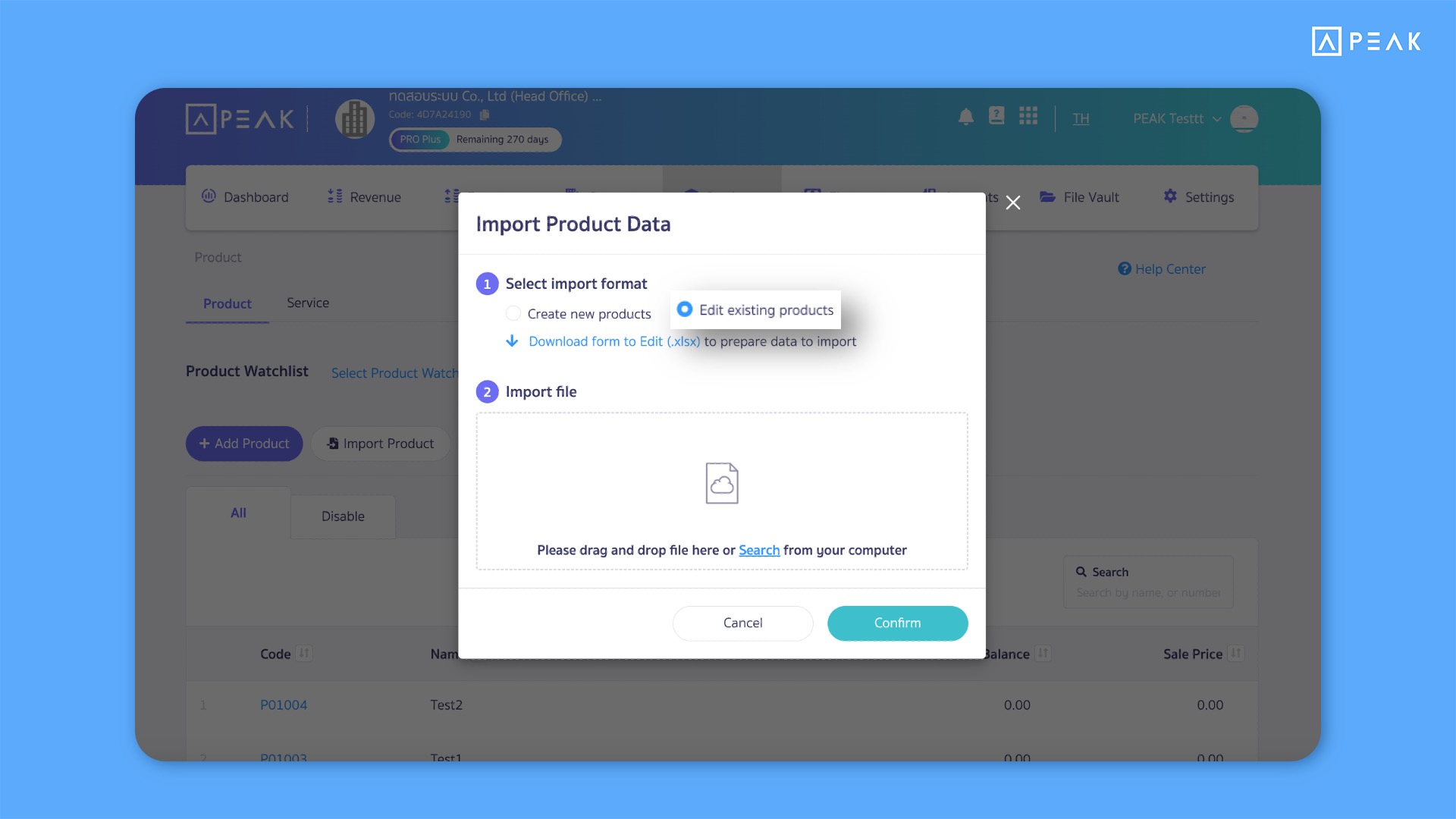

✨ 4. Improved the Product/Service Import functionality to simplify data management.

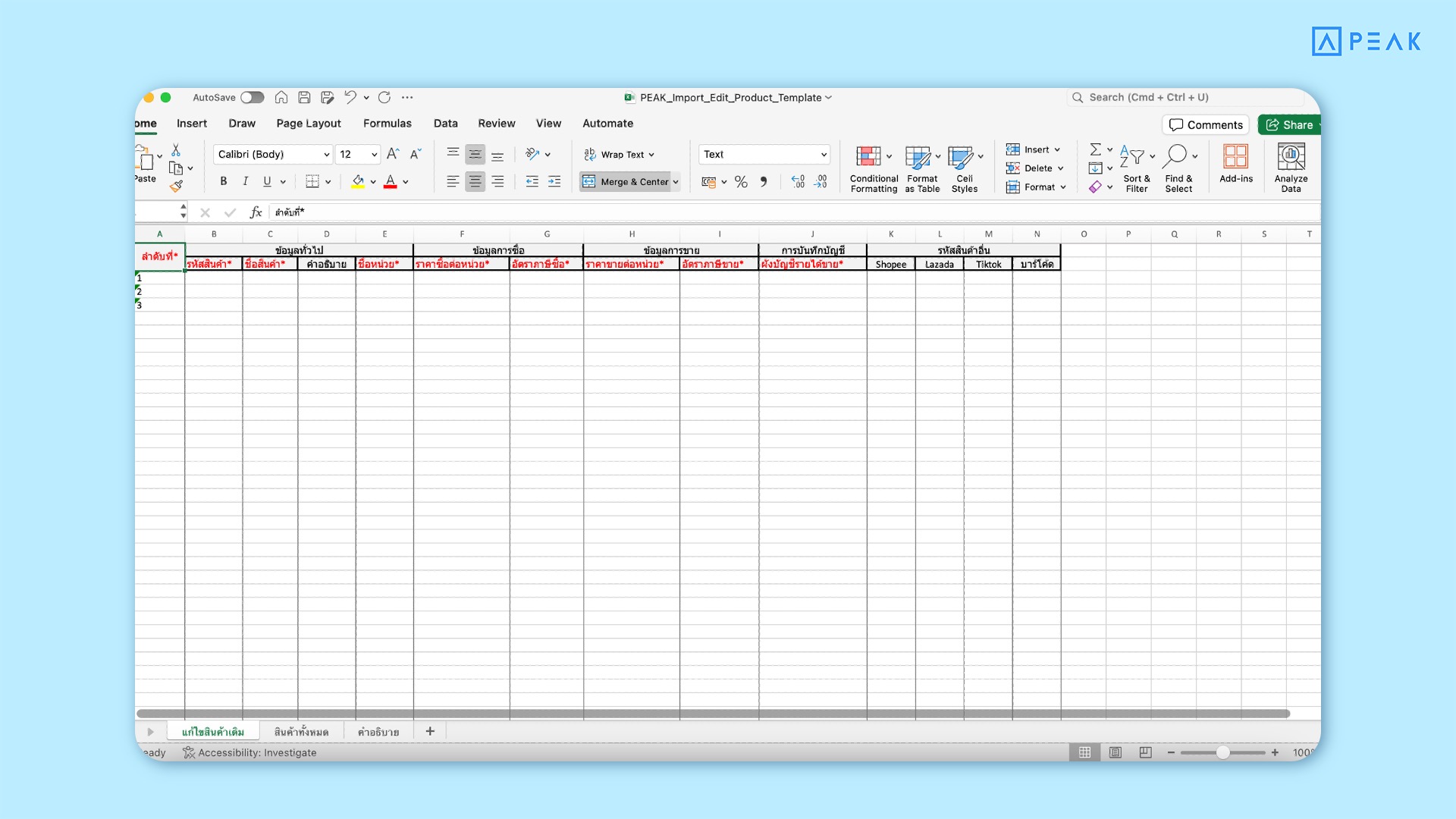

4.1 Add the option “Update Existing Products” to modify current data.

📢 For businesses that need to modify product/service information already in the system, you can now import the “Edit Existing Products” file. This feature allows users to update product/service information efficiently, and the system will automatically update the records. The imported file consists of 3 Sheets:

- Edit Existing Products: Specify only the products/services that need to be updated. Users can select the desired product/service to modify from the “All Products” sheet.

- All Products: Displays all product/service information currently in the system.

- Column Information Guidelines:

For the products/services you modify, the Product ID must match an existing ID in the system. If a product/service ID does not exist in the system, the file import will fail. This ensures accurate and seamless product/service data management, helping reduce errors and maintain operational efficiency.

Example of the “Edit Existing Products” Import File.

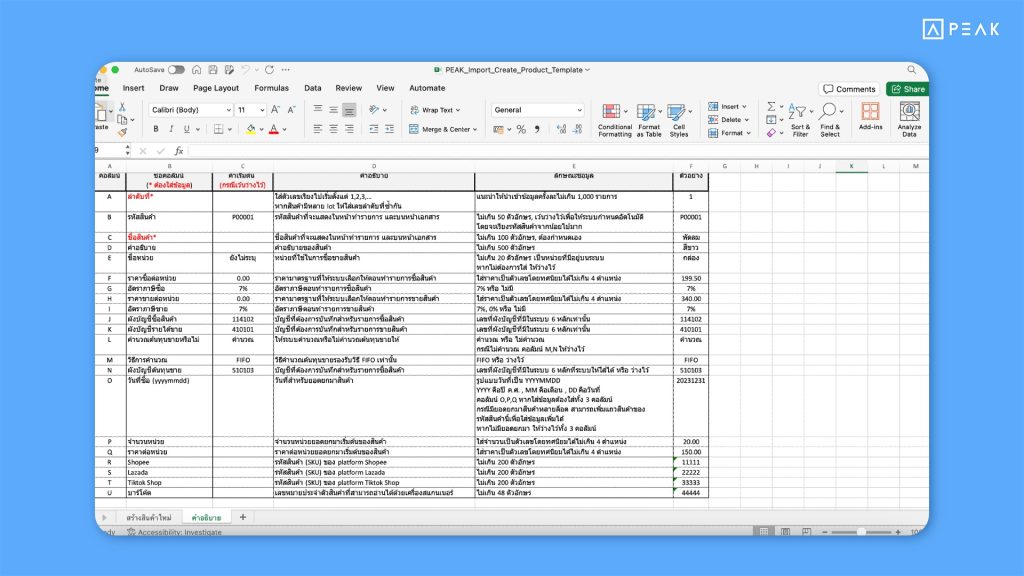

4.2 Add new columns in the product/service import file to align with system data requirements.

📢 The system now clarifies the descriptions and required information for importing files, ensuring better accuracy and transparency. Additionally, the product/service import file now includes an SKU column for integration with popular platforms like Shopee, Lazada, and TikTok Shop. If you input an SKU from these platforms—even if it hasn’t yet been configured—the system will automatically activate the SKU upon import. To ensure smooth and efficient data management, the system limits imports to 1,000 items per batch. This helps prevent errors and ensures reliable handling of large datasets.

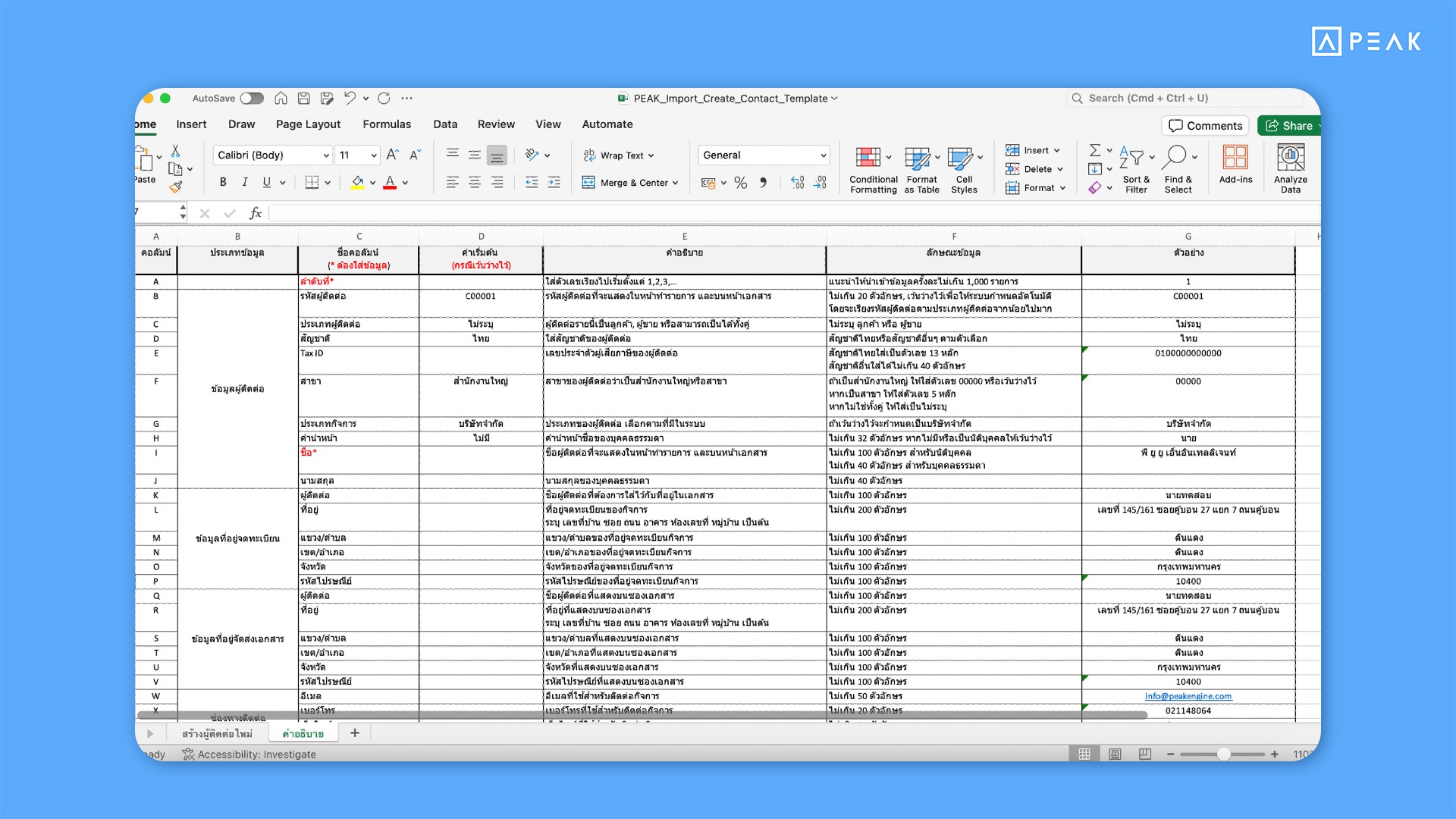

✨ 5. Improved the Contact Import functionality to make data management more convenient.

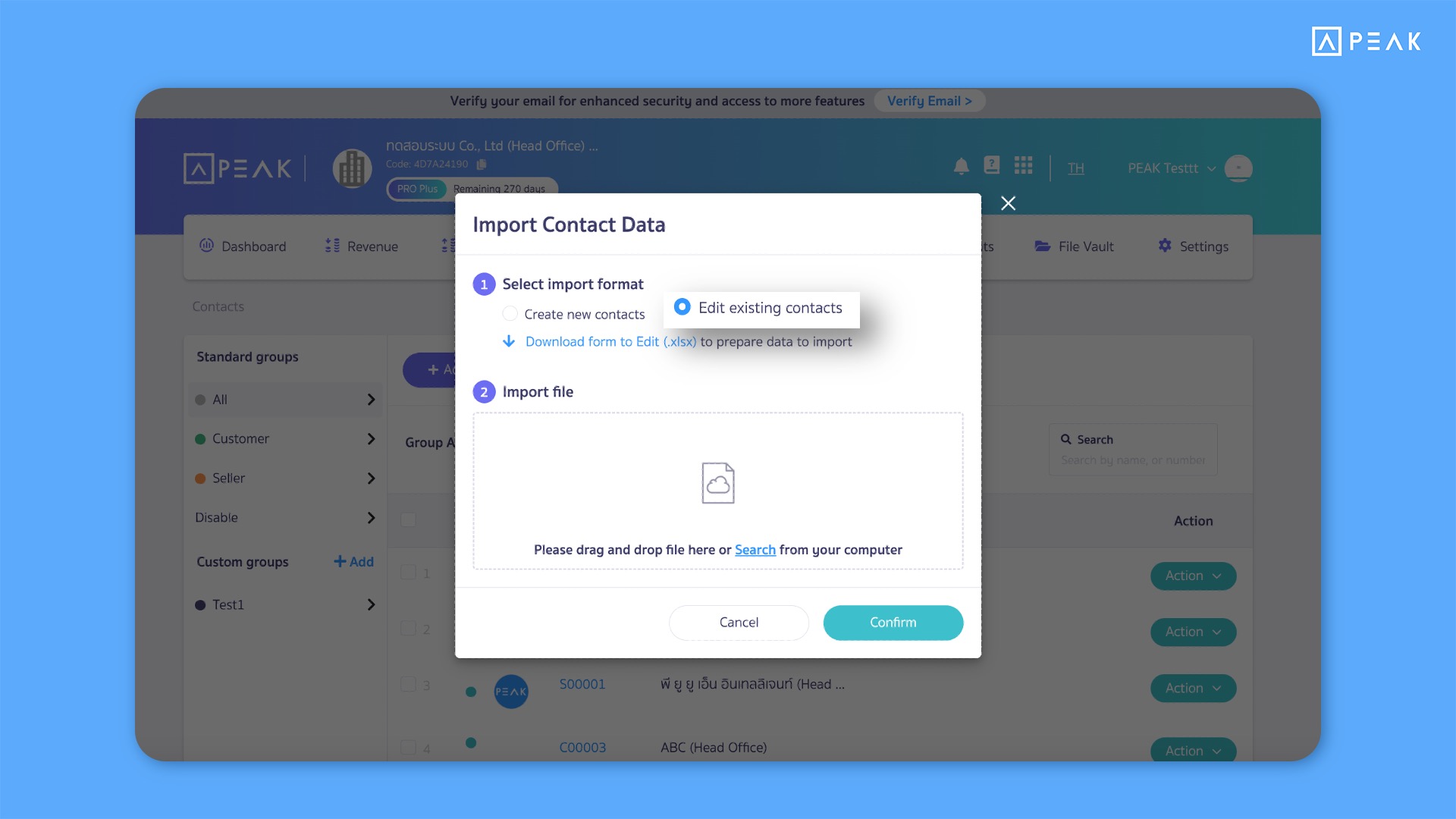

5.1 Add the option “Update Existing Contacts” to modify current data.

📢 For businesses that need to modify contact information already in the system, you can now use the “Edit Existing Contacts” import file. This allows users to efficiently update contact details, and the system will automatically refresh the contact information. The imported file is divided into 3 sheets:

- Edit Existing Contacts: Specify only the contacts that need updating. Users can select the desired contact from the “All Products” sheet.

- All Contacts: Displays all contact information currently present in the system.

- Column Descriptions:

Contact ID: Must match an existing ID in the system for updates to work correctly. If the contact ID does not exist, the system will reject the file import. By requiring matching IDs, this ensures accurate and seamless management of contact information while minimizing errors.

Example of the “Edit Existing Contacts” Import File.

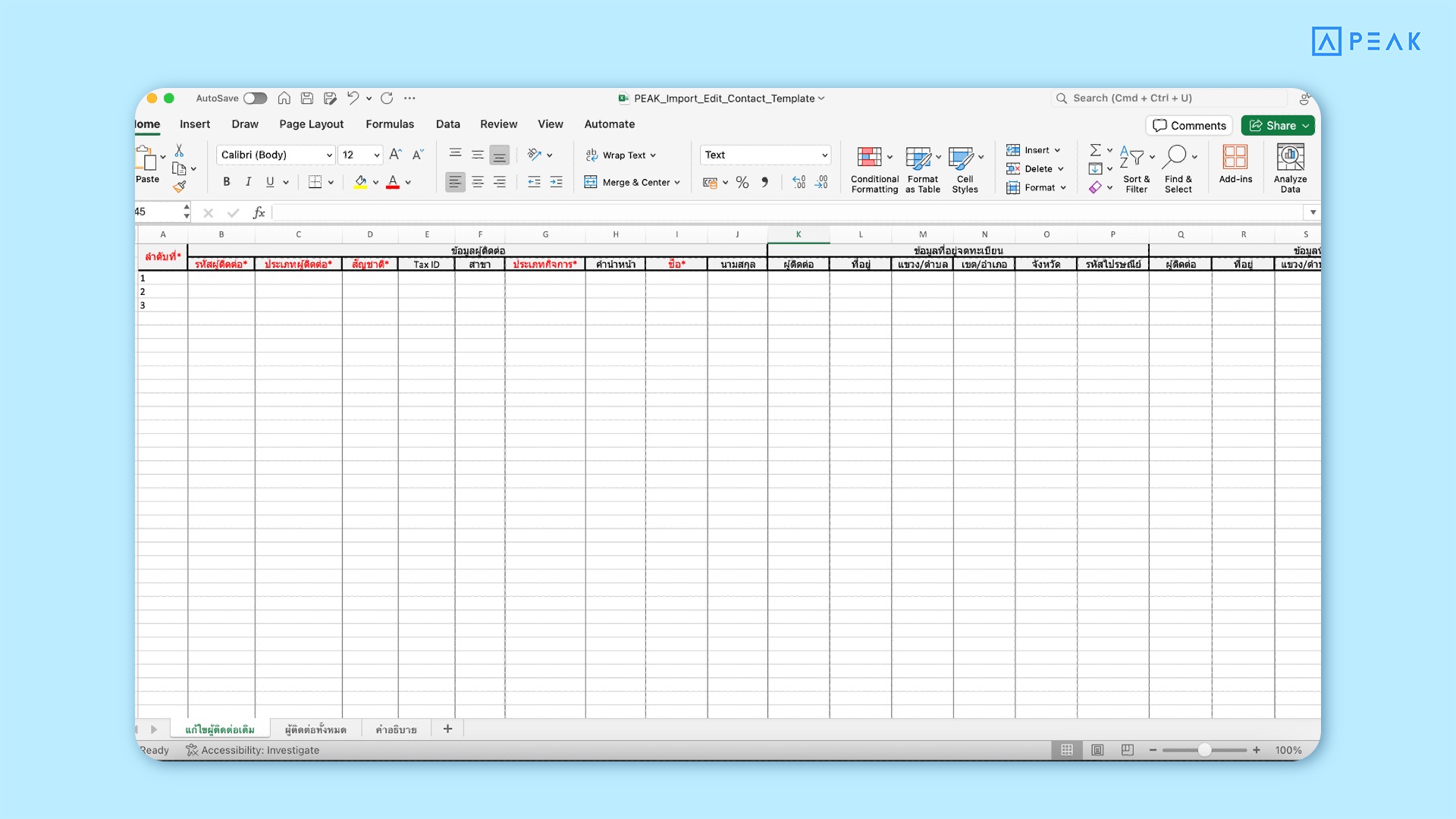

5.2 Add new columns in the contact import file to align with system data requirements.

📢 The system now clarifies descriptions and specifies the required information for importing files to ensure better accuracy. Additionally, the import file for contacts now includes new columns for Contact Type, Nationality, Delivery Address Information, Payment Due Date, Multiple Contact Persons and Contact Groups. If there is an error during the contact import (e.g., duplicate names), the system will immediately notify users. To support efficient data handling and reduce limitations, the system limits imports to 1,000 contacts per batch, ensuring seamless management of large datasets while maintaining user convenience.

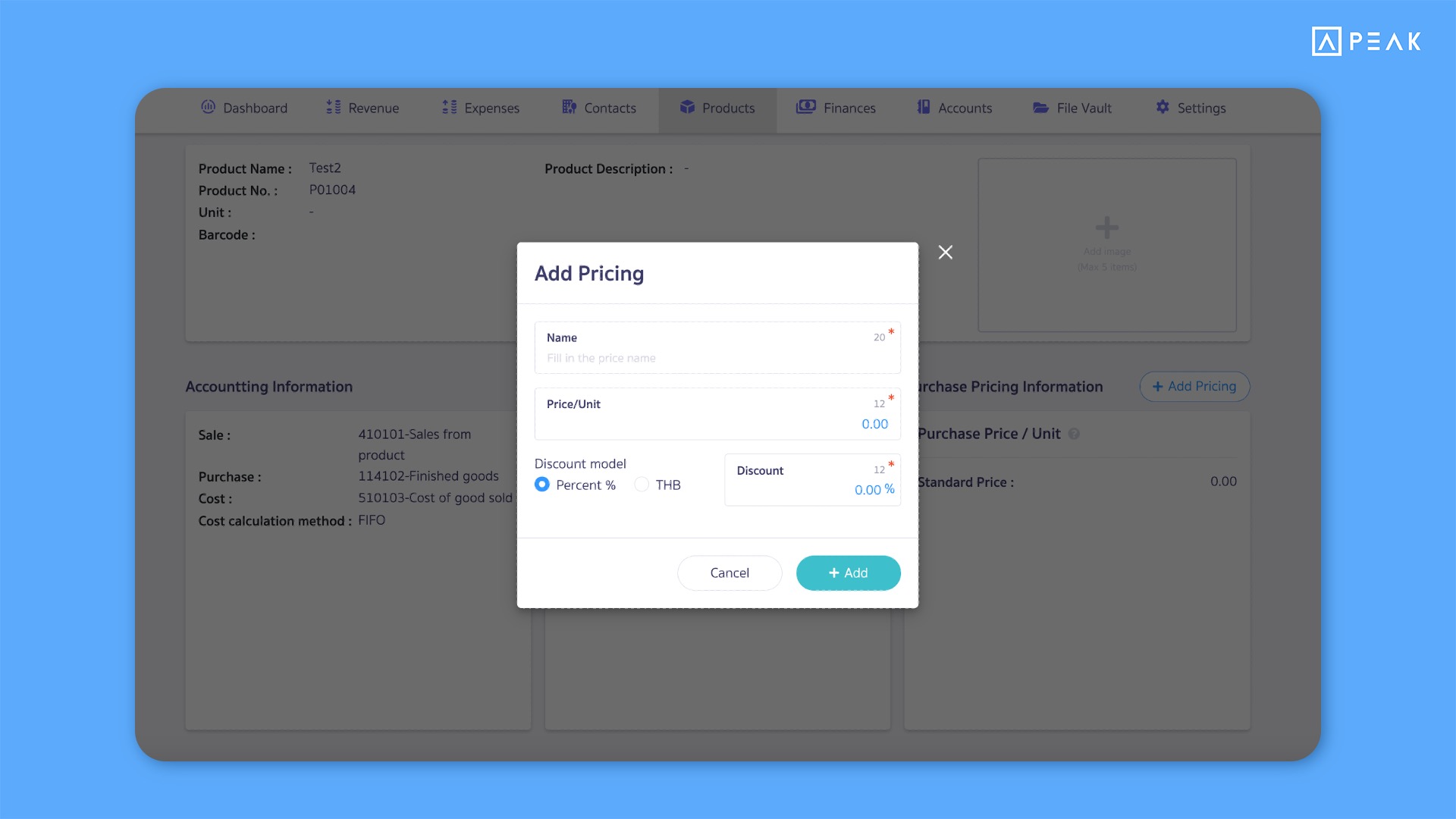

✨ 6. Increase pricing flexibility by allowing up to 10 price tiers for products/services.

📢 For e-commerce businesses managing multiple purchase-sale prices, the system now supports specifying up to 10 purchase-sale prices on each product/service page. This improvement allows users to efficiently manage product pricing with more flexibility and accuracy, ensuring a smoother pricing process and better operational convenience.

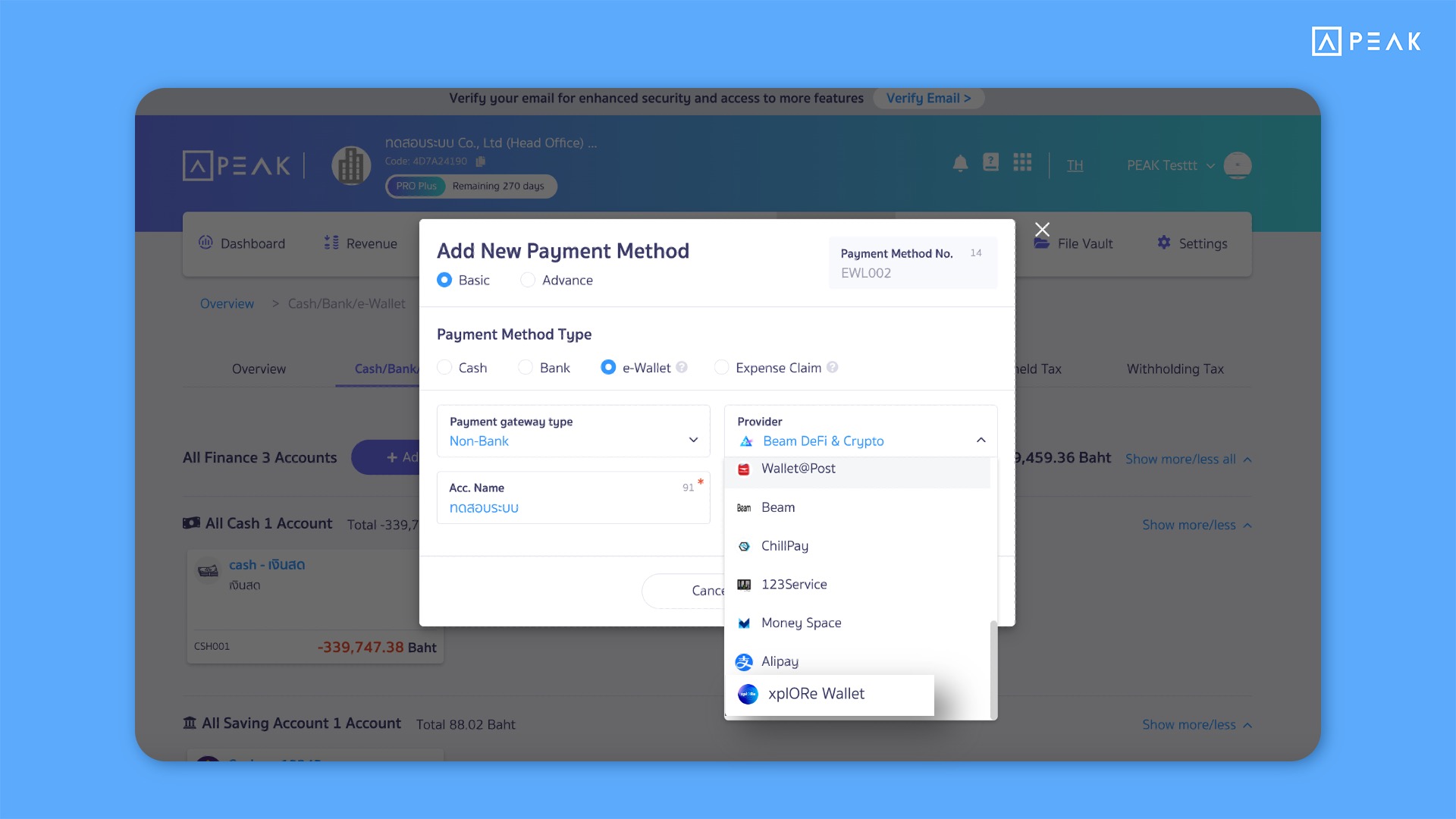

✨ 7. Enabled payment support via xplORe Wallet for enhanced convenience in payment collection.

📢 For all businesses, the system now supports the xplORe Wallet as an additional payment method, offering more flexibility in financial transactions.

Thank you for the suggestion K.Prapatsara, KONGKA Manufacturer Co., Ltd.