PEAK with the new function designed to enhance efficiency.

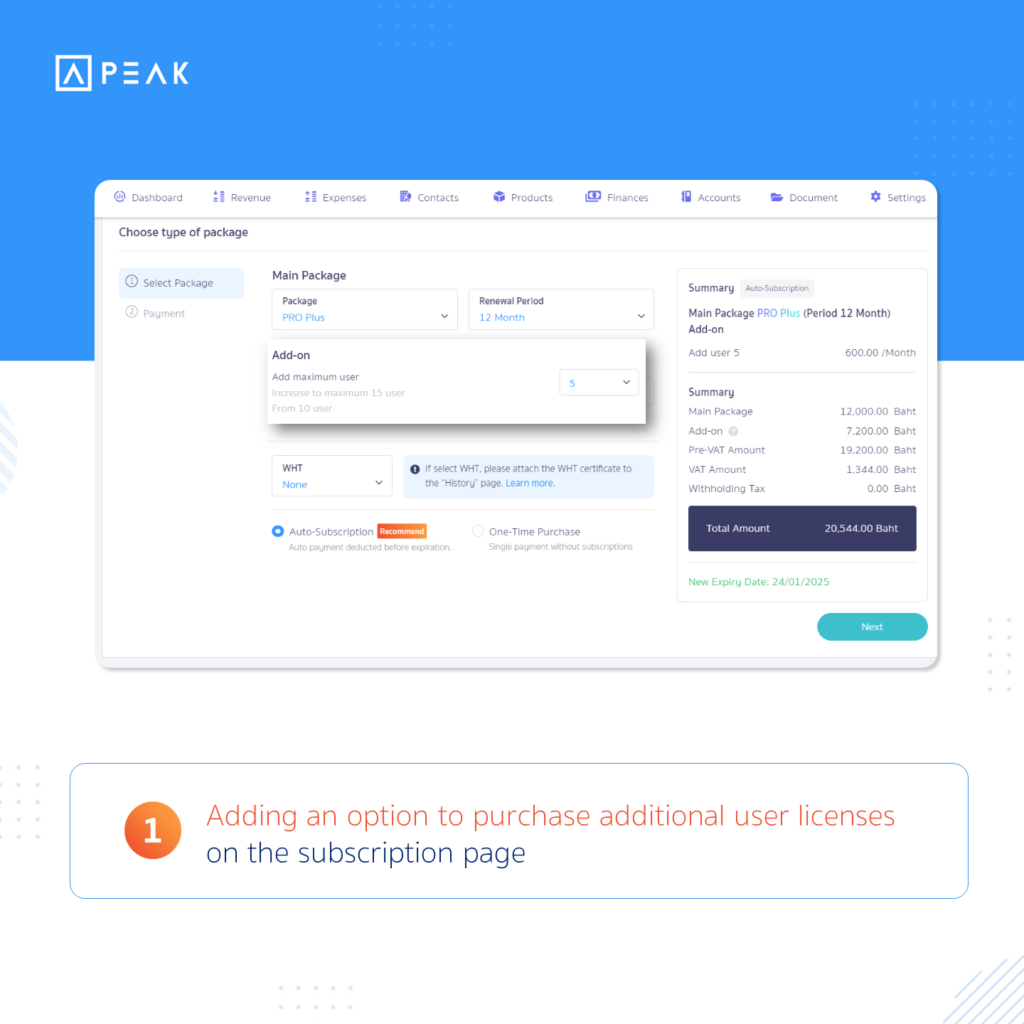

✨ 1. Adding an option to purchase additional user licenses on the subscription page

📢 For businesses looking to purchase additional user licenses, it is possible to buy extra packages along with extending the existing subscription. The expiration date for the additional package will align with the expiration date of the current subscription. The cost for adding users is 600 Baht for every 5 users per month and can be purchased with any subscription package.

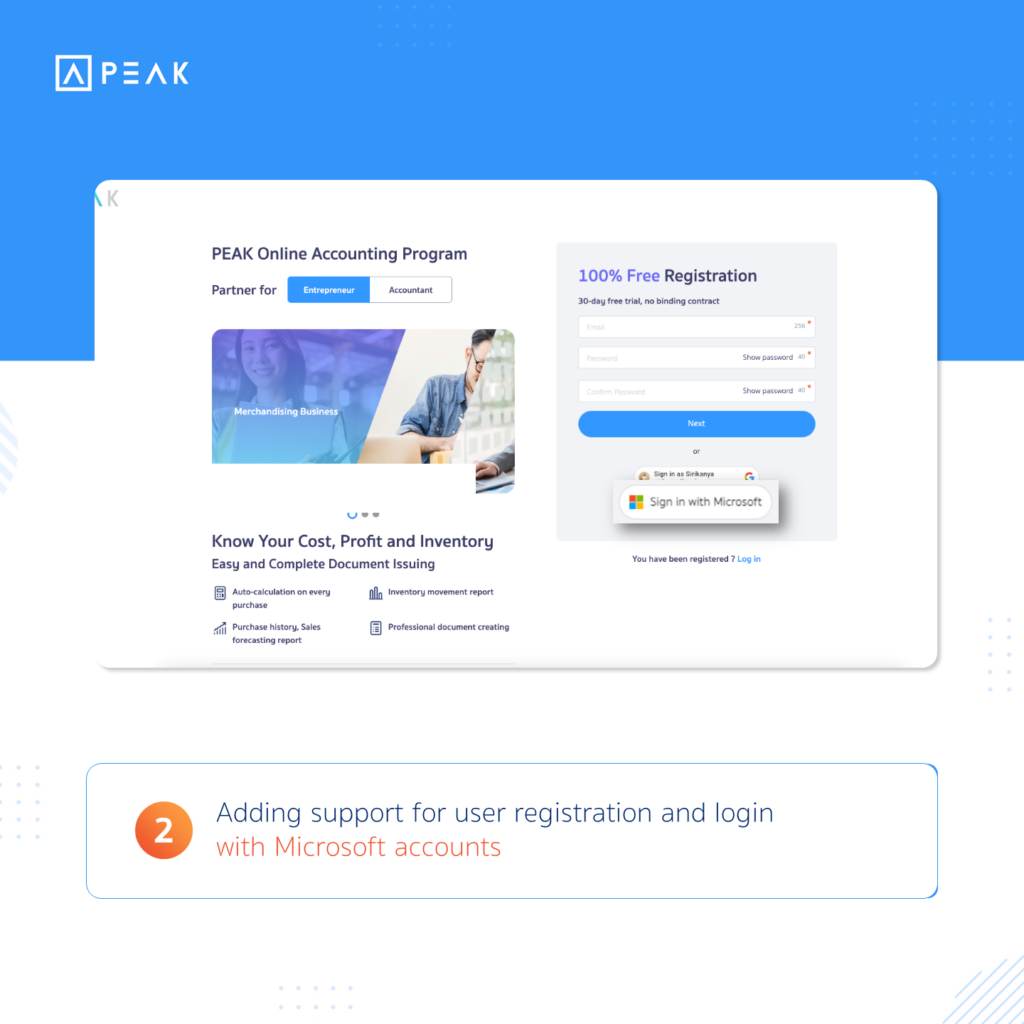

✨ 2. Adding support for user registration and login with Microsoft accounts

📢 For businesses that use a Microsoft account for work and want to use the PEAK program, you can now register using your Microsoft account. This allows users with different account types to access the program.

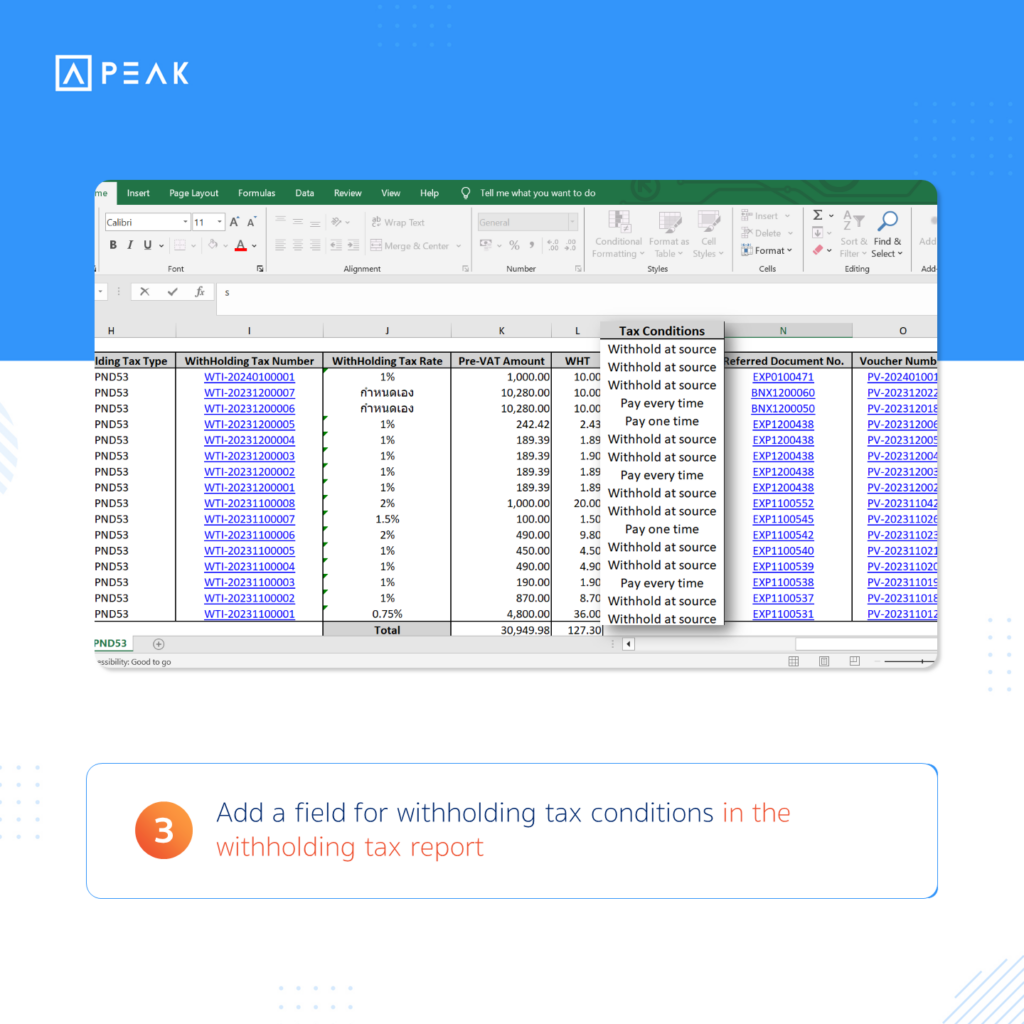

✨ 3. Add a field for withholding tax conditions in the withholding tax report

📢For businesses that print withholding tax reports, the withholding tax report will display information on tax withholding conditions (withholding, single issuance, ongoing issuance). This will help users can check and use it more conveniently

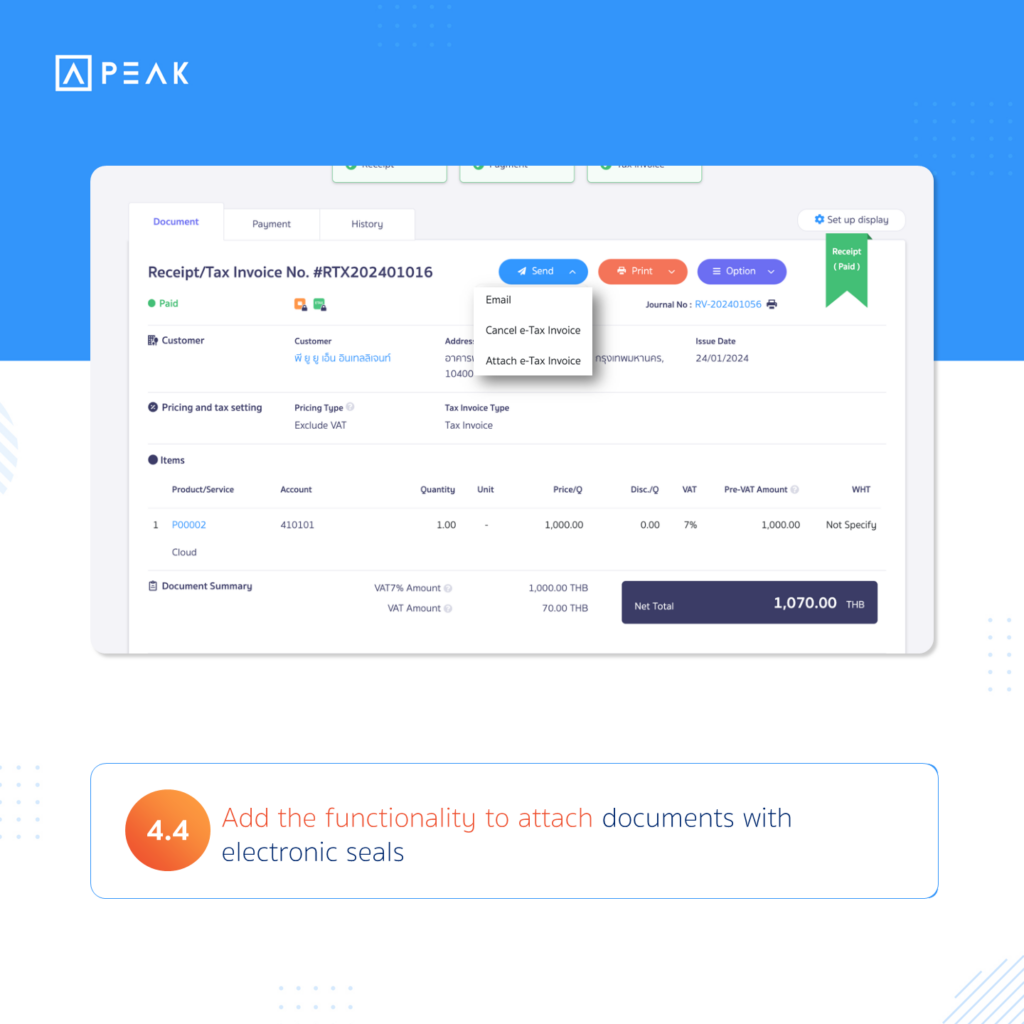

✨ 4. Add functionality related to e-Tax Invoice (usable exclusively on the PEAK)

📢For businesses utilizing e-Tax Invoice, additional functionalities have been introduced (available on the PEAK only) as follows:

4.1 Can submit e-Tax Invoices with descriptions exceeding 256 characters

If users enter a description exceeding 256 characters on the document page, they can still click ‘Submit e-Tax Invoice’ as usual.

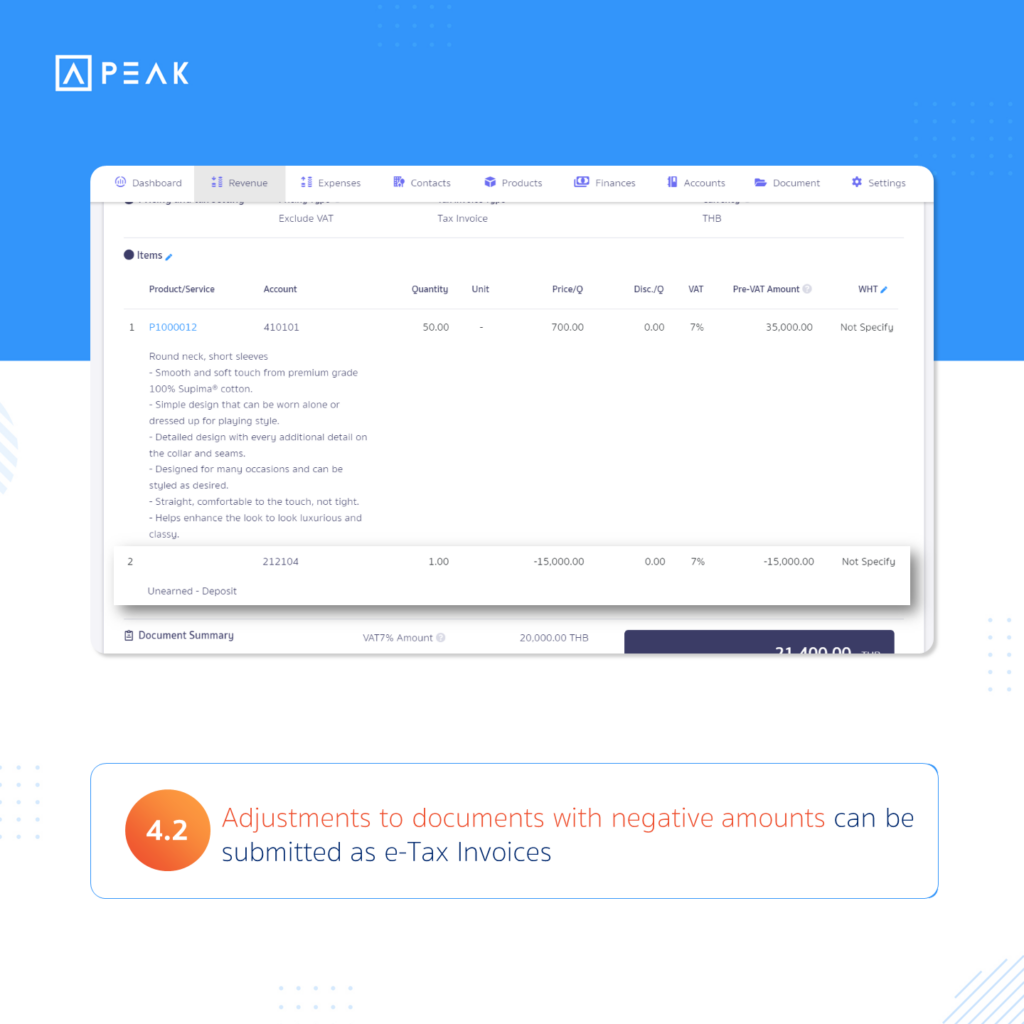

4.2 Adjustments to documents with negative amounts can be submitted as e-tax Invoices

For documents with negative amounts, such as those involving the use of deposit money, users can still click ‘Submit e-Tax Invoice’ on the document page.

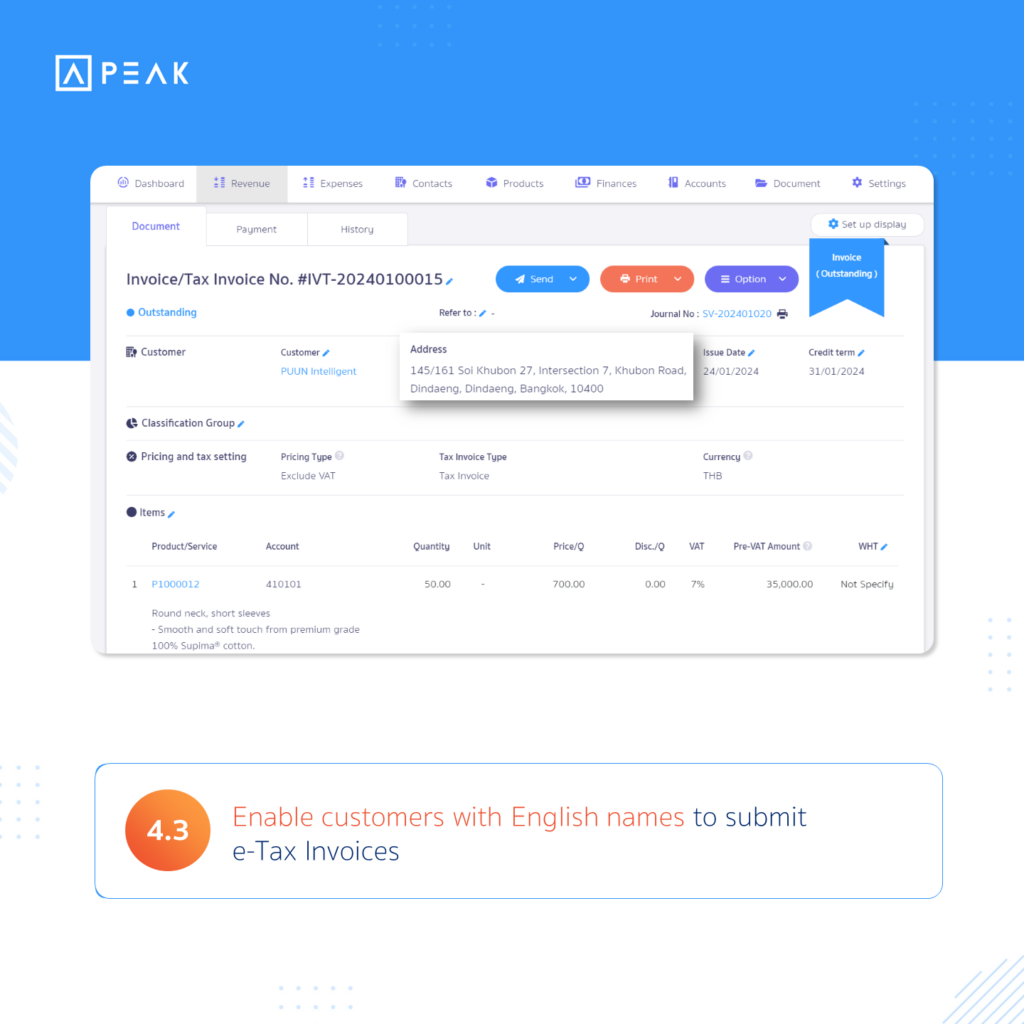

4.3 Enable customers with English names to submit e-Tax Invoices

In the case where users enter customer address information in English, whether the customer is located in Thailand or abroad, they can still click ‘Submit e-Tax Invoice’ on the document page.

4.4 Add the functionality to attach documents with electronic seals

If users are connected to INET and submit e-Tax Invoices through the program, but the document page in the system does not yet have an attached certified document file, users can click to attach the e-Tax Invoice file. This allows the system to pull in the document and attach the file, enabling users to send the document to customers while waiting for it to be queued for submission to INET.